Understanding the Criteria for Qualifying Free Zone Persons in the UAE

The UAE continues to attract business owners with its supportive regulatory environment and tax-efficient Free Zones. However, operating in a free zone isn’t enough to guarantee tax benefits under the new corporate tax regime. To fully benefit, your business must qualify as a “Qualifying Free Zone Person” (QFZP)—a status subject to specific conditions set by the UAE Ministry of Finance. Understanding whether you meet these conditions is essential to avoid unexpected tax liabilities and ensure you’re exploiting maximum tax benefits in the Free Zone setup. So, how do you determine if your business truly qualifies?

We will explore what it takes to be a Qualifying Free Zone Person, the key requirements, and how the right advisory firm, such as Premier Auditing & Accounting LLC, can support you.

Who is a Qualifying Free Zone Person in the UAE?

A Qualifying Free Zone Person is a company operating within a Free Zone in the UAE, meeting the special rules defined by the FTA. Because their income is taxed at 0%, these businesses enjoy a high value in the corporate tax system.

Just because your business is in a Free Zone doesn’t mean you automatically get qualified to become a Qualifying Free Zone Person. You have to align with a list of requirements to be eligible for tax advantages.

Let’s look at what it actually means to call yourself a free zone person in the UAE:

- You have registered your business with one of the recognized Free Zone Authorities (such as JAFZA, DAFZA, DIFC, DMCC or ADGM).

- Your business complies with corporate tax law in the UAE.

- You have to fulfill the qualifying income criteria, substance, and compliance standards.

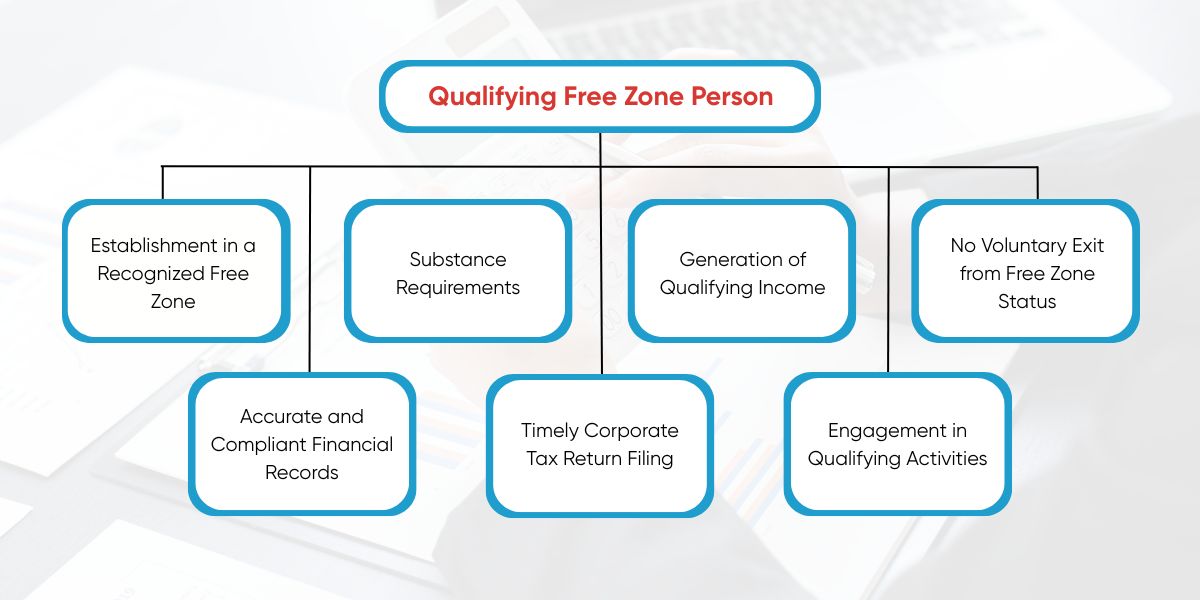

Key Requirements to Maintain Qualifying Free Zone Person Status

To maintain Qualifying Free Zone Person status, you must meet the requirements in the long term. You must maintain compliance throughout your business activities. Let’s look more closely at these requirements:

1. Establishment in a Recognized Free Zone

First, you need to ensure your company is operating in a recognized UAE Free Zone such as Jebel Ali Free Zone (JAFZA), Dubai Airport Free Zone (DAFZA), Dubai International Financial Centre (DIFC), Dubai Multi Commodities Centre (DMCC) or Abu Dhabi Global Market (ADGM).

Still, just registering is not the whole story. The business needs to remain active to be part of the Free Zone. Corporations set up only for legal purposes are very unlikely to meet the requirements of present corporate tax laws.

2. Substance Requirements

One primary requirement is that the Free Zone business shows economic substance. Part of this includes:

- The business has physical presence in the Free Zone.

- Employees who have the right qualifications are working in the Free Zone.

- Core Business activities that generates income are conducted within the Free Zone.

- Spending that is flexible responds to the size and style of the business.

The Federal Tax Authority will verify your business activities to ensure that your company was not set up only to save on taxes but to engage in real Free Zone business activities.

3. Generation of Qualifying Income

Your company must make qualifying income to keep its qualifying free zone person status. Normally, these covers:

- Profits are brought in by selling to other Free Zone companies.

- Earning passively with dividends, interest, and royalties.

- Profits earned by taking part in manufacturing, trading, shipping or specific professional services within the Free Zone.

- Income from contracts entered into and performed within the Free Zone.

When engaging in business with the UAE mainland, your business earnings are rarely recognized as qualifying income and can be taxed according to general corporate tax rules. You could forfeit the entire benefit if many of your activities do not qualify for the 0% rate.

4. No Voluntary Exit from Free Zone Status

If a Free Zone business wants to maintain its Free Zone Person status, it cannot give up its Free Zone membership on its own. If you let your license expire or go to the mainland, you may lose access to the tax benefits.

For Example, if your company’s activities no longer meet Free Zone requirements and you depend mainly on the mainland, your organization will likely lose its status.

5. Accurate and Compliant Financial Records

It is very important to keep detailed, easily accessible financial documents. This includes:

- Maintaining accurate accounting books and financial quarterly reports.

- Following the Free Zone authority or FTA’s rule for annual audits.

- Making sure the financial statements follows international financial reporting standards (IFRS).

To understand these unique aspects, consulting with one of the best audit firms in UAE, Premier Auditing & Accounting LLC, is necessary. Because of their expertise, your financial activities ensure to comply with the requirements.

Moreover, we are registered and approved auditors with most of the major Free Zone authorities, including JAFZA, DMCC, DIFC, DWC, IFZA, and more. This enables us to provide seamless audit and accounting services across a wide range of Free Zones, tailored to your business needs.

6. Timely Corporate Tax Return Filing

Even when your company’s corporate tax rate is 0%, you still need to file a corporate tax return each year. Not doing this may result in fines, penalties, or losing your Free Zone Person status. When preparing your tax return, all your sources of income, expenses, and profits should be disclosed correctly.

7. Engagement in Qualifying Activities

The activities that can be used to qualify are given by the FTA and include:

- Processes involved in manufacturing and production of goods or materials

- Trading of qualifying commodities

- Holding shares for Investment

- Offering reinsurance and management of funds, wealth or investments

- The company handles headquarters and treasury services as part of its management functions.

- Service in shipping and logistics

- Financing and leasing of Aircrafts

- Distribution of goods or materials

- Any activities that are ancillary to the above

You need to confirm that this list approves all your business operations. Working in areas outside of the free zone, mainly those dealing with customers on the mainland, could affect your business status.

Are You Truly a Qualifying Free Zone Person?

One of the most significant advantages of Qualifying Free Zone Persons in the UAE is the exemption from corporate tax on eligible profits. Setting up in a Free Zone is essential, but it isn’t the only thing necessary. To comply, you have to physically operate your business in the country, get income from the qualifying activities, and file your returns, regardless of the amount you earn.

Don’t participate in mainland activities unless you are okay with paying higher taxes. Should the whole process seem hard to handle, Premier Auditing & Accounting LLC can ease your stress and ensure you follow the rules. Contact us today to have your status reviewed.