Mastering How to Calculate UAE Corporate Income Tax Provision

Concerned about how much tax your company pays before filing? You are not the only one. With the UAE’s 9% corporate tax now implemented, it is becoming more important than ever to know how to calculate corporate income tax provision so you can report correctly and confidently make decisions.

A tax provision is not only a figure but a testament to your company’s prowess in planning, complying, and risk management. This blog aids you in understanding the ins and outs of calculating your tax provision, synchronising it with the UAE tax calendar, and when to refer to trusted tax advisors such as Premier Auditing & Accounting LLC, a leading audit firm in Dubai.

What Is a Corporate Income Tax Provision?

It is an amount set aside in your financial statements to account for the income tax your company expects to pay. It is recorded before the actual return is filed and the final tax amount is determined.

This item will appear on your balance sheet as a current liability and is essential to financial disclosure. If inaccurate, stakeholders will be deceived, auditors might raise discrepancies, and your business will risk non-compliance. Now, with corporate tax UAE laws in effect, accuracy in provisioning is more critical than ever before.

According to UAE tax law:

- Taxable income of the first AED 375,000 is levied at 0%

- Income over this is taxed at 9%

However, to arrive at the correct provision, you first need to determine the proper taxable income, which means adjusting your accounting profit.

Step-by-Step Guide to Determining Your Tax Provision

Determining your corporate tax provision isn’t a matter of simply applying a straight rate – it involves adjusting your profit according to tax regulations, exemptions, and compliance considerations. Here’s a breakdown to help you through it.

1. Begin with Your Accounting Profit

Your net profit before tax under IFRS is your starting point. This amount will have to be tax-adjusted.

2. Add Back Non-Deductible Expenses

Not every expense in your books is deductible. Some of the items that need to be added back are:

- Fines and penalties

- Some entertainment expenses

- Donations not given to approved bodies

- Unrealized provisions or reserves

If ignored, there might be an underestimated taxable income and an incorrect tax provision.

Example

If your net profit is AED 900,000 and includes AED 20,000 in fines, your adjusted profit becomes AED 920,000.

3. Subtract Exempt Income

Some incomes are exempt under UAE law. You need to exclude qualifying amounts like:

Dividends on UAE-resident companies Qualifying free zone income Foreign branch income (if criteria are met)

These adjustments help in shifting to taxable income.

Example

If you earned AED 100,000 from a free zone activity that qualifies for exemption, it will be subject to 0% corporate tax.

4. Check Transfer Pricing Impact

If your company deals with related parties, compliance with transfer pricing is necessary. A sound transfer pricing arrangement confirms you’re utilizing the arm’s-length principle and explaining how you’ve priced intra-group transactions. Adjustments might be required if prices don’t correspond with market levels.

A properly written transfer pricing agreement strengthens your compliance position, minimizes the risk of penalties, and ensures taxable income is presented accurately. It also has a direct impact on your tax provision calculation, particularly when internal margins are high.

5. Account for Interest Deduction Limits

The UAE restricts interest expenses to a specified percentage of EBITDA for some businesses. If your net interest expense does not exceed AED 12 Million, it’s fully deductible. If this threshold is exceeded, the taxable person may deduct the higher of the threshold (i.e. AED 12 Million) or 30% of EBITDA, the excess amount has to be added back to the calculation of taxable income.

Example

If your EBITDA is AED 10 million and your net interest expense is AED 15 Million, only AED 12 Million is deductible and the leftover AED 3 Million will be added back to taxable income.

6. Complete Taxable Income and Apply Tax Rates

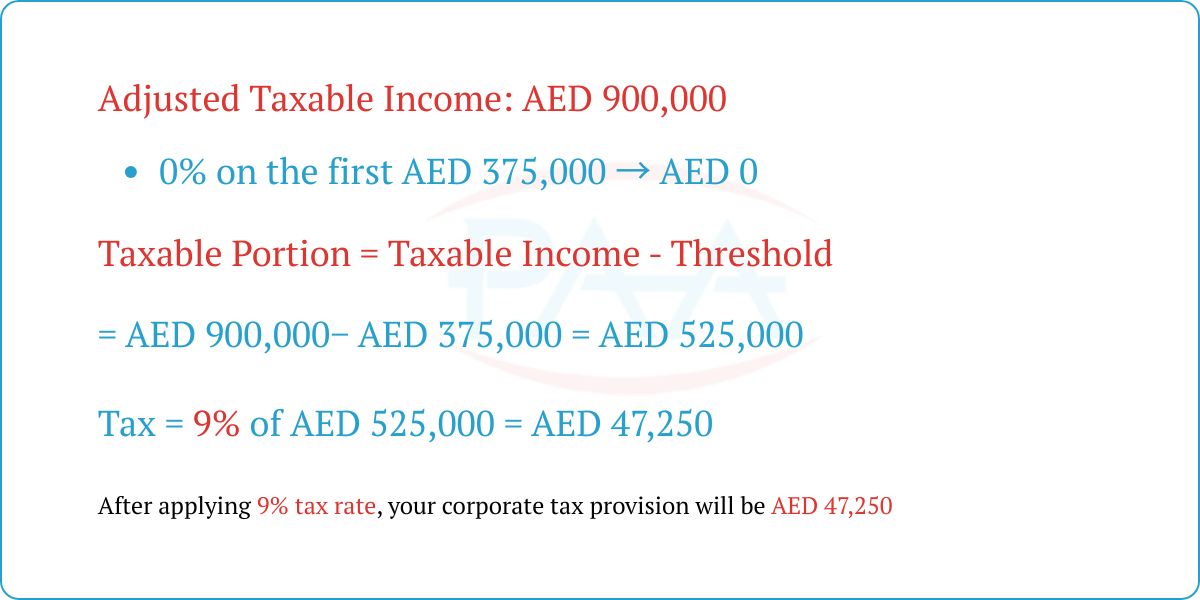

After all adjustments are complete, apply the 0% and 9% rates to the taxable income to determine your corporate income tax provision. Example Calculation: Adjusted taxable income: AED 900,000 0% on first AED 375,000 = AED 0 9% on AED 525,000 = AED 47,250 (this is your tax provision)

7. Record the Provision

The tax amount which is arrived must be posted as a current liability. In case your company has temporary timing differences in accounting and tax treatments, you might need to account for deferred tax liabilities or assets as well.

Practical Examples: How to Calculate UAE Corporate Income Tax Provision

Understanding theory is essential, but examples make it real. Below are sample calculations that illustrate how tax provisions are determined in line with UAE corporate tax rules.

Example 1: Small Business with Limited Adjustments

Company A Financials:

- Accounting Profit (Before Tax): AED 600,000 Non-

- Deductible Expenses (e.g., fines, disallowed donations): AED 20,000

- Exempt Income (e.g., UAE-sourced dividend): AED 50,000

Calculation Steps

- Adjusted Profit = AED 600,000 + 20,000 – 50,000 = AED 570,000

- Taxable Income = AED 570,000

- Tax Provision =

- 0% on first AED 375,000 = AED 0

- 9% on AED 195,000 = AED 17,550

Tax Provision to Record = AED 17,550 Example

2: Medium Enterprise With Interest Cap and Transfer Pricing Impact

Company B Financials

- Accounting Profit: AED 15,000,000

- Interest Expense: AED 13,000,000

- EBITDA: AED 20,000,000

- Related party adjustments: +AED 40,000 (due to under-priced internal sales)

Calculation Steps

1. Adjusted Profit = AED 15,000,000

- AED 40,000 (TP adjustment)

- AED 15,040,000 will be the adjusted taxable income.

2. Calculate Interest Expense Deductible Limit

- Deductible limit is the greater of: AED 12 million

- 30% of EBITDA = 30% × 20,000,000 = AED 6,000,000

- Since AED 12 million > AED 6,000,000, the deductible limit is AED 12 million.

- Interest expense = AED 13,000,000 < AED 12 million,

So AED 12 Million interest expense is deductible and Balance AED 1 Million is to be added back to Taxable income.

3. Tax Provision for AED 16,040,000

- 0% on first AED 375,000 = AED 0 •

- 9% on AED 15,665,000 = AED 1,409,850 Tax

Provision to Record = AED 1,409,850

Corporate Tax Services Are Key to Accurate Tax

Provisioning It’s not simply checking the compliance box to know how to calculate corporate income tax provision – it’s about safeguarding your financial integrity. A properly calculated provision gives assurance that your company is on top of things, open to disclosure, and prepared to take responsibility.

In a fresh and amending tax laws, such as in the UAE, it’s not hard to overlook minor but essential adjustments regarding deductions, interest caps, or transfer pricing. That’s why companies are going to tax experts such as Premier Auditing & Accounting LLC – a leading provider of tax consultancy services in Dubai and end-to-end corporate tax services. They’ll get your numbers right and your tax filing compliant.