UAE with its central location, regulations, and business-friendly tax structures that make it a good business location, one policy of the UAE that directly benefits its business activities is Value Added Tax (VAT) at a minimum rate of 5% which is very low when compared to rest of the world.

Your financial activities and business’s reputation greatly depend on VAT registration with the Federal Tax Authority (FTA). Although quite complex, the VAT registration process can be very easily handled if given proper guidance. This guide carries all the details related to the VAT application process, documents required for VAT registration, and related best practices.

What is VAT?

VAT or Value Added Tax, is a consumption tax levied on most goods and services in the UAE. It is collected by an entity on behalf of the government and is fixed at a flat rate of 5%. You must register, charge VAT on sales, and file tax reports with the FTA if your company generates revenue to a threshold limit to meet certain requirements.

Because it ensures openness in business transactions and generates government tax revenue, hence VAT is essential to the UAE’s economy. In addition to being required by law, VAT registration gives firms legitimacy and enables tax recovery on expenses spent related to their operations.

Who Must Register for VAT?

Businesses fall into two main registration categories

Mandatory VAT Registration

- If your business has an annual taxable supplies exceeding AED 375,000 in the past 12 months or,

- If you expect the taxable supplies to exceed AED 375,000 within the next 30 days.

Voluntary VAT Registration

- If your taxable supplies exceed AED 187,500 but below AED 375,000 per year.

- This is beneficial for those businesses wishing to recover VAT on expenses though their business not reached the mandatory threshold limit.

Consequences of Late Registration

Penalty for late registration is AED 10,000. Delays in the VAT registration process can also cause issues for businesses with supplier relationships, tender submission and so on. Meeting the VAT registration deadlines saves the business unnecessary penalty payments.

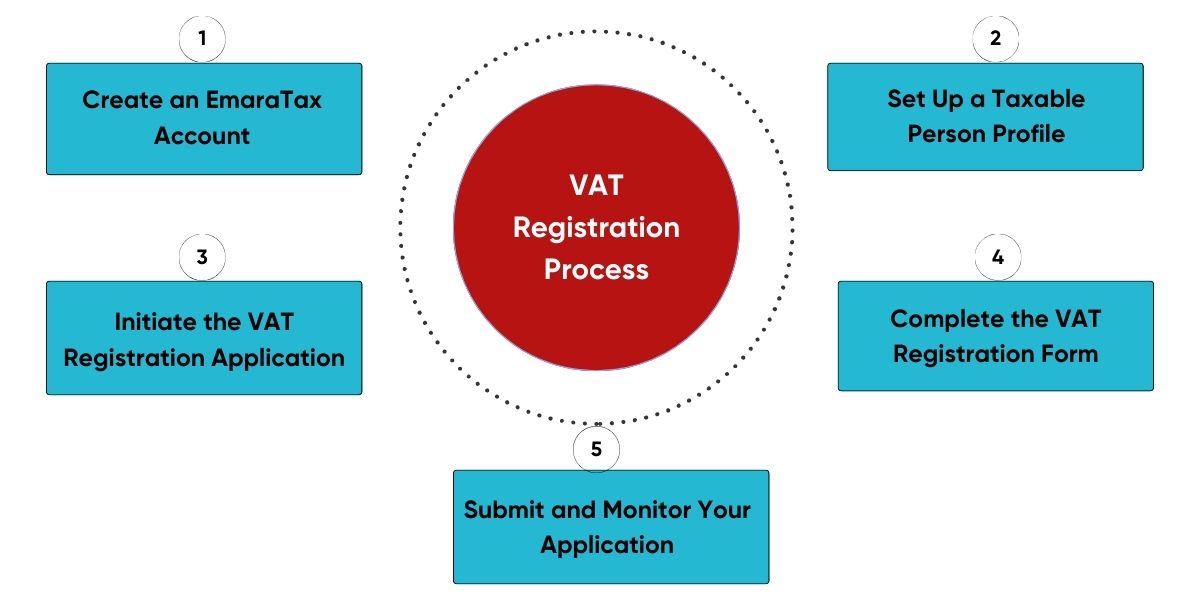

Step-by-Step VAT Registration Process

The UAE has made online VAT registration accessible through the EmaraTax portal, an online system managed by the FTA. Although the process is straightforward, accuracy is essential to avoid delays or rejections.

Step 1: Create an EmaraTax Account

- Visit the FTA website www.tax.gov.ae and register for an account by entering the necessary information, like your name, email address, and mobile number.

- Use UAEPass for faster authentication and access.

- Log in to your account to begin the registration process.

Step 2: Set Up a Taxable Person

- Profile Navigate to the Taxable Person Profile section through your EmaraTax dashboard.

- Enter essential business details such as trade name, business type, and contact information.

- Submit your profile for verification before proceeding to the next step.

Step 3: Initiate the VAT Registration Application

- Select the VAT Registration option and choose the correct registration type (mandatory or voluntary).

- Carefully review all provided details before moving forward.

Step 4: Complete the VAT Registration Form

- Provide details about your business activities, expected turnover, and taxable expenses.

- Upload the required VAT registration documents required.

Step 5: Submit and Monitor Your Application

- Review your application thoroughly before submission.

- The FTA typically processes VAT applications within 20 business days.

- You can track your application status in the EmaraTax dashboard to stay updated.

Businesses can reduce the possibility of delays or rejections by carefully following these steps, ensuring a seamless VAT registration process. For extra assurance and expert guidance, consulting with a VAT registration consultant can speed up the procedure, guarantee successful VAT registration, and ensure compliance with all legal standards.

Essential Documents for VAT Registration

For smooth registration, it is advisable to get your paperwork ready before applying. Having these documents in place can help avoid hassles that may arise during the registration process.

Business Documentation

- Trade License – Confirms the legal status of your business.

- Owner’s Identification Documents – Passport and Emirates ID copies of the business owner(s).

- Power of Attorney (if applicable) – Required if an authorized representative is managing the business.

- Company Contact Details – Official business address, phone number, and email.

Financial Documentation:

- Bank Account Details – Proof of a UAE-based business bank account.

- Financial Statements – Recent audited or unaudited financial records.

- Revenue Forecasts – Estimated financial projections, especially for voluntary registration.

- Expense Records – Evidence of VAT-incurred business expenditure.

Avoiding Common Pitfalls in VAT Registration

Though the procedure for VAT registration is digital, business people still encounter delays due to errors. Some of the most common mistakes include

Incorrect Business Information

Even minor discrepancies in company details can lead to application rejections. Thus, make sure to always cross-check trade licenses and official records before submitting the application.

Incomplete Documentation

Missing required documents often causes delays in processing. Ensure you have all the required paperwork ready before starting the application.

Complex Business Structures

Businesses with multiple branches, multiple owners, or operating in multiple industries will require more paperwork.

Processing Delay

If an application has been filled out incorrectly or a higher volume of applications is in the process of being approved, this delays the approval process. Moreover, the FTA may experience a high volume of applications, especially close to VAT filing deadlines. Therefore, submitting the application well in advance and ensuring all details are correct can help avoid such delays.

Before submitting your VAT registration, carefully review all entries and attached documents. Ensuring completeness and accuracy will save time and prevent unnecessary delays in obtaining your VAT registration number.

What to Remember About the VAT Registration Process

It takes meticulous preparation and close attention to detail to register VAT in the UAE. Having the appropriate knowledge on your side can have a huge impact. Professional assistance can save time and avoid expensive errors for companies who are not familiar with UAE tax rules.

Many businesses trust the best VAT consultant in Dubai to ensure smooth VAT registration and compliance. For businesses seeking expert guidance, appoint Premier Auditing and Accounting for the best VAT registration and compliance services.

Our knowledgeable experts facilitate effective tax system navigation for companies of all sizes. Get in touch with Premier Auditing and Accounting right now for expert VAT support.