UAE Tax Calendar and Deadlines: You Should Know For 2025

Several recent amendments have been introduced to the UAE’s tax regime. With the UAE tax calendar for 2025 active, companies must keep track of important deadlines to ensure full compliance. Continue reading to discover the most essential tax deadlines for 2025, including VAT returns, Excise tax returns, Corporate tax returns, and the minimum tax for multinational companies.

The guide also highlights how the availability of VAT consultants in UAE, such as those providing auditing services and tax services, can make it easier.

UAE Corporate Tax Insights for 2025

UAE corporate tax applies to businesses that earn profits above AED 375,000 in a year. Companies have to file their tax returns within 9 months from the end of the tax period and pay the tax due within the deadline.

Deadline for Registration of Corporate Tax

UAE resident entities incorporated / established on or after 1 March 2024, the entity must register for corporate tax within 3 months from the date of incorporation. Taxable Person incorporated, established or recognized under laws of foreign jurisdiction that is effectively managed and controlled in the UAE, they must register for corporate tax within 3 months from the end of the financial year.

UAE Tax Calendar for Corporate Tax Return

Companies need to file their tax returns within nine months from the end of their relevant tax period. The following are some common filing dates for 2025

- If your tax year ending on 30 September 2024, your return should be filed by 30 June 2025.

- If your tax year ending on 31 December 2024, submit by 30 September 2025.

- If your tax year ending on 31 March 2025, your return should be filed by 31 December 2025.

It is essential to know your business’ financial year-end so as not to miss your UAE corporate tax return due date. Failure to meet the deadline may incur penalties of AED 500 for each month for the first 12 months, thereafter AED 1000 per month.

VAT Filing in 2025

Value Added Tax (VAT) continues to be a key component of the UAE tax environment. VAT-registered businesses are required to submit VAT returns either quarterly—if their annual turnover is below AED 150 million—or monthly, for businesses with an annual turnover of AED 150 million or more.

VAT Return Filing

The FTA assigns a tax period to every business based on its effective date of registration. Businesses must file VAT returns within 28 days after the end of each tax period. VAT delays can attract penalties and additional charges.

VAT Payment Deadlines

In addition to submitting VAT returns, businesses in the UAE are required to settle their VAT payments by the due date. Late payments can result in significant penalties based on number of days delayed. A 2% penalty is applied immediately after the due date on the unpaid amount, followed by an additional 4% if the payment remains unpaid after seven days. If the delay continues, a 1% daily penalty is charged starting one month after the due date, up to a maximum of 300% of the unpaid tax.

New Tax: Domestic Minimum Top-up Tax (DMTT)

As of 1 January 2025, the UAE has introduced a 15% Domestic Minimum Top-up Tax on big multinational corporations. The tax will apply to corporations with global annual revenues surpassing €750 million. The new regulation guarantees that such corporations pay a reasonable quantum of taxes and do not transfer profits to low-tax jurisdictions.

If your business is among the above categories, it’s high time to plan ahead. Consult reputed auditing & accounting firms in Dubai like Premier Auditing & Accounting LLC to evaluate the impact of this new tax on your business.

What If You Miss a Deadline?

Missing deadlines for taxes can result in penalties, loss of money, and legal complications. The following are the consequences of failing to meet critical tax dates

- Late corporate tax registration: AED 10,000 fine (FTA may waive the fine on certain conditions).

- Late corporate tax return filing: Fines of AED 500, with monthly increments of AED 1000 after 12 months.

- Late VAT filing or payment: For late filing – Fine of AED 1,000 for the first time and AED 2000 in case of repetition; For late payment – a percentage of the outstanding tax.

- Incorrect filings: Administrative fines and additional scrutiny by the FTA.

To avoid these fines and penalties, companies must plan ahead. For this, you should have a tax calendar for the entire year and schedule all crucial dates. You could also hire tax consultants to handle your tax compliance.

Key UAE Tax Calendar Reminders For 2025

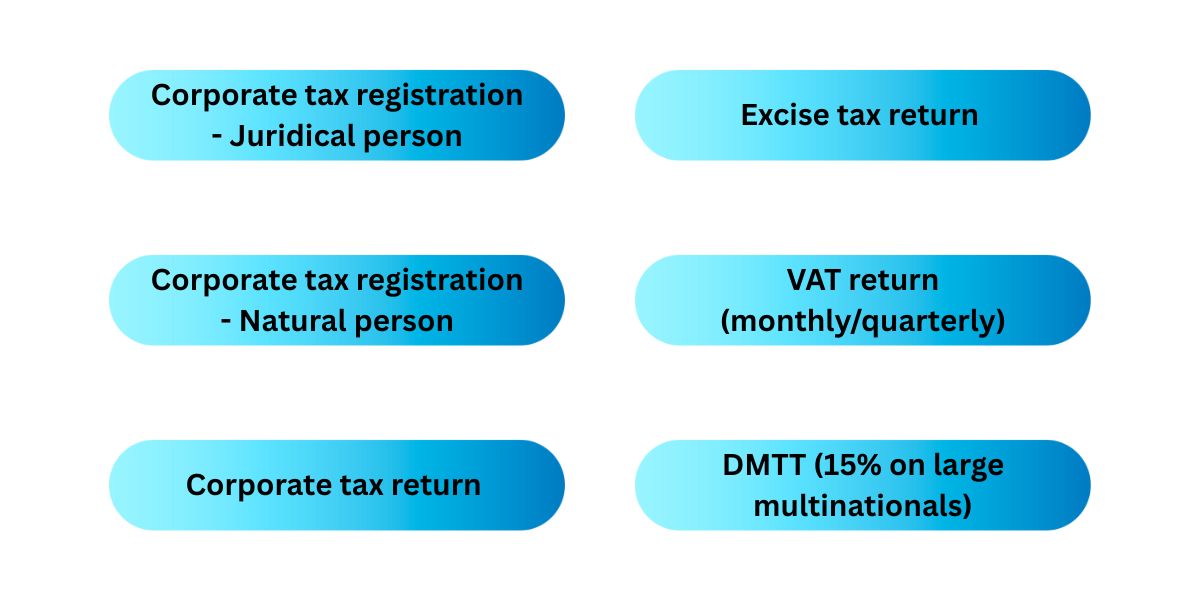

Here is a quick rundown on the key tax deadlines and requirements in 2025

| Requirement | Deadline |

|---|---|

| Corporate tax registration – Juridical person | Within 3 months from the date of incorporation |

| Corporate tax registration – Natural person | For resident person – 31 March of the subsequent Gregorian calendar year; For non-resident person – 3 months from the date of meeting the threshold limit. |

| Corporate tax return | Within nine months after the tax period ends |

| Excise tax return | Within 15 days after the tax period ends |

| VAT return (monthly/quarterly) | Within 28 days after the tax period ends |

| DMTT (15% on large multinationals) | Applicable From 1 January 2025 |

Maximize Your Benefits with the UAE Tax Calendar 2025

Having the UAE tax calendar at your fingertips is one thing—utilizing it to its fullest potential is another. For 2025, companies need to use this calendar as a working tool, not merely a list of dates.

By matching your financial activities to the tax calendar, you will guarantee timely fulfilment of all tax requirements, and thereby you can avoid unnecessary penalties.

Begin by establishing your company tax period and VAT filing schedule. After that, align your internal operations – bookkeeping, invoice tracking, and closing accounting dates – with corresponding submission deadlines. This will simplify your tax compliance process.

Here are some extra tips to get the most out of the tax calendar

- Create reminders: Utilize computer programs to create reminders for important filing deadlines so nothing falls through the cracks.

- Check documents regularly: Have monthly or quarterly internal audits to make sure your books are accurate and ready to submit.

- Plan in advance: If your accounting year is ending, begin preparing your tax returns months before the due date.

For businesses that lack internal expertise and want to avoid compliance issues, hiring VAT consultants in the UAE or firms offering tax services in Dubai is a smart option. Professional auditing services in Dubai like Premier Auditing & Accounting LLC, can ensure you meet every deadline accurately while maintaining clean, penalty-free records.

Stay Ahead of Your 2025 Tax Obligations

The UAE 2025 tax calendar introduces corporate tax return dates, Excise/VAT return submission deadlines, and new requirements such as the Domestic Minimum Top-up Tax. Delays or incorrect filings attract penalties; therefore, completing each deadline becomes important.

Proper planning and consistent monitoring of the corporate tax period in the UAE are essential for staying compliant and financially healthy throughout the year. While staying updated is essential, handling it all in-house can be overwhelming, particularly as rules shift. That’s where the experts come in.

Premier Auditing and Accounting LLC provides holistic solutions, from auditing service to VAT return support and tailored tax services. Their knowledge means no filing gets missed, and your business remains compliant. Don’t wait for fines make the UAE tax calendar a part of your plan and let the pros keep you on schedule.