Understanding Different Types of Bookkeeping Services

Fundamentally, bookkeeping is the methodical process of documenting and arranging a company’s financial transactions. It entails keeping careful tabs on earnings, outlays, acquisitions, sales, and other financial operations. This fundamental procedure aims to create an understandable, precise, and ready record of a business’s financial information rather than just entering data.

The foundation for wise business decisions is accurate bookkeeping. Businesses without bookkeeping may function in the dark, unable to predict, budget, or comprehend their financial performance. They can make well-informed financial decisions by using the ordered view of income and expenses that bookkeeping offers.

This blog discusses the various types of bookkeeping services any business, from a start-up to a multinational corporation, can avail from accounting firms in Dubai.

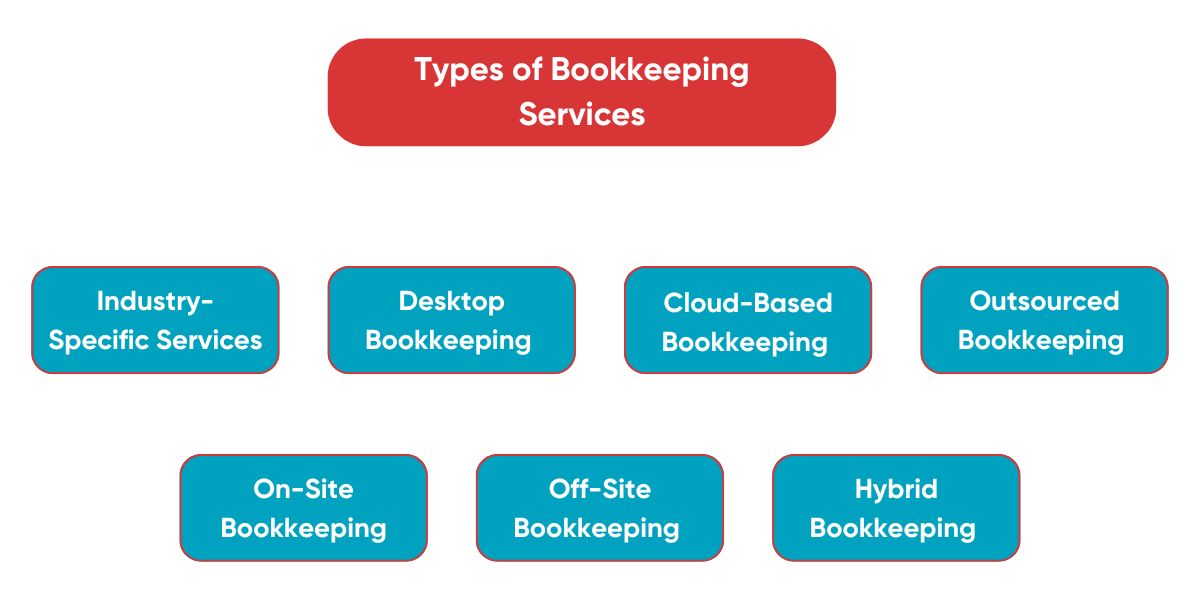

Various Types of Bookkeeping Services

To accommodate a range of needs, the contemporary company environment provides various types of bookkeeping service options. These services fall into a number of general categories according to their delivery method, technology, and focus.

Industry-Specific Services

Depending on their needs, specific industries require specialized bookkeeping services.

- Construction companies use various types of bookkeeping in accounting systems, involving project-based accounting, job costing, and others specifically related to construction.

- Retail companies have to account for sales tax as well as monitor and reconcile point-of-sale systems for online sales.

- Restaurants must manage inventory, track food costs, and handle tip reporting.

These bookkeeping service options are designed to meet the unique needs and reporting specifications of every sector.

Key performance indicators (KPIs), industry-specific charts of accounts, and compliance requirements are all known to specialized bookkeepers. This knowledge allows accounting firms to make sure that financial documents are correct and pertinent and offer significant information for making decisions. As one of the top accounting firms in Dubai, Premier Auditing and Accounting can manage specific bookkeeping needs and guarantee adherence to sector-specific rules.

Desktop Bookkeeping

Desktop Bookkeeping uses software that is installed directly on a computer. One well-known example of a radically different type of bookkeeping is QuickBooks Desktop. These applications provide an extensive feature set for handling accounting functions, such as financial reporting, payroll, and invoicing. Nevertheless, desktop solutions may be more expensive up front, need manual backups, and be less accessible than cloud-based alternatives.

The appeal of desktop bookkeeping software lies in its autonomy: companies dictate their own backup schedules, safeguard their own data, and sidestep the constantly changing policies of cloud providers. Yet with this control comes responsibility: security updates must be installed manually, and real-time collaboration is often a luxury rather than a standard feature.

For businesses that value discretion, prefer a single purchase to an endless subscription, and view remote access as optional rather than essential, desktop solutions remain a dependable option.

Cloud-Based Bookkeeping

The most popular bookkeeping systems are cloud-based because they are accessible, can be worked on collaboratively, and automatically back up your data. That is all thanks to programs like Zoho, Xero, Odoo, QuickBooks Online, and FreshBooks, all of which allow businesses to access their finances at any time from any place with an internet connection. These services typically include capabilities such as real-time financial reporting, bank reconciliation, and automated invoicing. Bookkeepers, accountants, and business owners can also communicate easily with some cloud-based solutions.

Cloud-based bookkeeping is ideal for businesses that require access to financial data while on the go or for remote workers since it is accessible anywhere. The common integration of cloud-based platforms with other business applications, like CRM and e-commerce systems, also creates a seamless flow of information between different business divisions. Firms like Premier Auditing and Accounting take this foundation further, creating tailored solutions that align with each client’s operations.

Outsourced Bookkeeping Entrusting a third party with bookkeeping responsibilities allows businesses to offload an important and more time-consuming task. For small and mid-sized firms, it is an especially practical alternative, offering expert oversight without the expense of an in-house hire. But delegation demands diligence. A trusted provider can introduce efficiency, but only if selected with care and managed through transparent communication. In Dubai, where regulatory complexity adds another layer of challenge, companies frequently seek specialized accounting services from best accounting firms in Dubai like Premier Auditing and Accounting. The same logic applies to audits, where working with a leading firm ensures compliance and financial integrity.

On-Site Bookkeeping

On-site bookkeeping services become embedded in the company’s daily workflow, gaining an intimate understanding of financial patterns and potential pitfalls. Their ability to monitor transactions in real time and quickly address irregularities ensures that small problems do not spiral into major setbacks.

This close integration also improves communication between departments, resulting in teams being able to align their budgets and financial goals with greater precision. On-site bookkeeping allows for a more synchronized and proactive work environment where financial decisions are based on immediate insights rather than delayed reports.

Off-Site Bookkeeping

Off-site bookkeeping with a third party offers companies a direct line to specialized expertise without the expense of maintaining an in-house accounting team. Business owners can rely on professionals who utilize cutting-edge software and streamlined methodologies to deliver meticulous, real-time financial oversight.

With outsourced off-site bookkeeping, business owners can channel their time and resources into scaling their operations, developing new strategies, and refining their competitive position in the market.

Hybrid Bookkeeping

This approach works by splitting responsibilities between internal teams and external experts. Companies retain everyday tasks like invoicing, reconciliations, and payroll internally, keeping it readily accessible for external experts for the overall bookkeeping. More intricate responsibilities such as tax planning, financial forecasting, and regulatory compliance are outsourced to specialists like Premier Auditing and Accounting, they have advanced expertise in these areas.

Investing in Financial Clarity with Leading Bookkeeping Service in Dubai

Bookkeeping has effectively been the backbone of accounting and auditing services for businesses. Its benefits go way beyond just financial tracking. Effective bookkeeping services make the repetitious task of a recurrent nature easier. As outlined in this article, different types of bookkeeping services exist for Dubai businesses’ unique needs, from onsite to cloud services.

This includes data entry, payroll, budget and financial reporting. Such tasks are made way simpler by automation software, facilitating the businesses’ focus on more opportunities for growth. Companies that partner with professional accounting and bookkeeping services firms like Premier Auditing and Accounting LLC gain an edge with greater financial transparency, reduced operational costs, and a more efficient workflow.