The Most Common Types of Audit Services and Their Benefits

Factors that can significantly help you with navigating your business include audits which are performed in various methods. These audit services are meant for financial accuracy, enhance operational efficiency, risk management, and comply with regulatory standards. Audit services help create accuracy and confidence in every business, whether you are starting up a new business or managing the existing one.

Most professional auditing firms ease the process by providing different types of audits that you require according to your business needs.

When it comes to audit service, there are several different approaches and ways to add value to your organization.

What are the Types of Audit Services and How Do They Work?

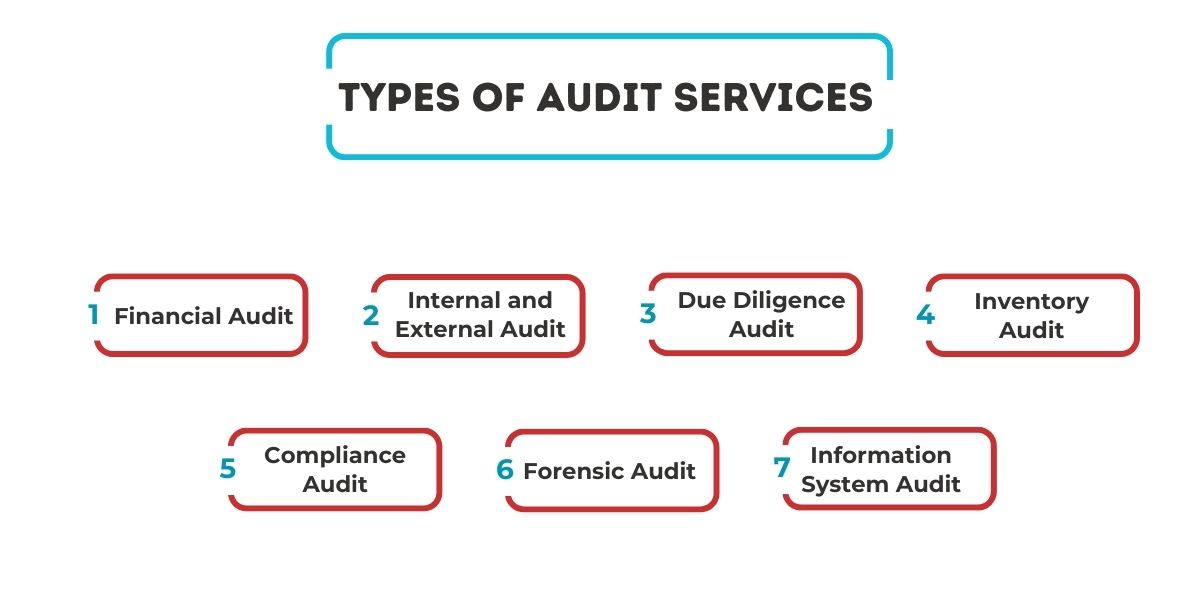

There are several types of audits that serve different purposes and focus on various aspects of an organization. According to the specific goal, every audit is performed to address certain objectives of financial accuracy, regulatory requirements, business performance, and so on. We are going to present the most frequently conducted audits as narrated below

1. Financial Audit

A financial audit mainly focuses on asserting the accuracy of financial statements of an Organization. It ensures that financial statements are free from material misstatement and comply with regulations, nurturing trust among investors, customers, creditors, and regulators.

Key Benefits of Financial Audit

- Assessing the accuracy and fairness of the financial statements

- Enhance the transparency with stakeholders confidence

- Ensures compliance with accounting standards and regulations

Financial audit mostly conducted for regulatory purposes only; that is why they constitute an integral part of every business audit, as they reveal the fairness of the financial activities performed and serve to improve them.

Premier Auditing and Accounting, provides Financial Audit services offering a comprehensive suite of audit and assurance solutions tailored to meet the specific needs of the client.

2. Internal and External Audit

Internal and external audits, though often mentioned together, serve different purposes and are conducted either by internal or outsourced

Internal Audits

Internal audits are conducted by the firm’s internal auditors or outside consultants to assess internal controls, risk management, and governance processes within the organization. Internal audit services from Premier Auditing are guided by a comprehensive, validated methodology, which is carried out by qualified professionals performed with an in-depth understanding of the business culture, systems, and processes.

Key Benefits of Internal Audit

- Identifies potential risks and help mitigate them

- Provides better internal controls, procedures, and overall operations

- Enhanced compliance with internal policies and regulatory requirement

External Audit

Independent auditing firms conducts external audit. The primary purpose of external audit is to confirm the accuracy of the financial records and compliance of company’s financial / internal policies to specific rules and regulations. External Auditors like Premier Auditing & Accounting, examine the organization’s financial records and assess the internal control systems as a basis to form an audit opinion on the financial statements.

Key Benefits of Financial Audit

- Examining the accuracy of the financial records

- Enhances the credibility of financial statements, that results in stakeholders confidence

- Ensures compliance with laws and regulations, avoiding potential penalties

3. Due Diligence Audit

A due diligence audit is vital in major business deals like mergers and acquisitions. It reviews the target company’s performance, operational efficiency, legal compliance, and reputation.

Why Due Diligence Audit is Important:

- Identifying the weaknesses and mitigate potential risks

- Insights in to business viability to find investment opportunity

- Enabling improved negotiation outcomes and decision-making

For instance, if a tech startup wants to acquire another company, a due diligence audit checks if the target company’s networth value is fair. Auditing firms like Premier Auditing & Accounting, verify the accuracy of the information provided by the target company that help businesses feel confident in making business deals.

4. Inventory Audit

Managing stock is crucial for most retail, wholesale and manufacturing companies. It involves checking inventory records against the actual stock available.

Benefits of Inventory Audit

- Identifying discrepancies between book stock and actual stock

- Reducing losses due to theft, mismanagement, or errors

- Ensuring proper valuation of inventory in financial statements

For instance, a large retail chain may use an inventory audit for year-end reporting. Auditing firms like Premier Auditing & Accounting, use tools like RFID and data analytics for reviewing inventory records.

5. Compliance Audit

Compliance audit ensure a business follows laws, regulations, and internal policies. Compliance audit is essential for business with strict regulations.

Industries that Benefit Most

- Healthcare: Given the sensitivity of patient information, it ensures that data is handled in compliance with privacy laws

- Manufacturing: Ensuring that an organization complies with the laid-down environmental laws

- Money Exchange: Compliance ensures exchange house meets regulations and follow anti-money laundering laws

For instance, a pharmaceutical company may conduct a compliance audit to ensure it meets health regulations. Accounting firms in Dubai, like Premier Auditing & Accounting, play a crucial role in helping businesses identify potential compliance gaps, address issues promptly, and avoid penalties for non-compliance, ensuring long-term success and regulatory adherence.

6. Forensic Audit

Where there are concerns of fraud, embezzlement, or any other unusual activity carried out in business dealings, then forensic audit comes in. Forensic Audit involves investigation to uncover financial fraud, misconduct or criminal activity which always result in legal proceedings.

Key uses of Forensic Audit:

- Uncovering fraudulent transactions or misconduct

- Resolving disputes between business partners or stakeholders

- Gathering evidence in legal cases for use in court

For instance, a company might request a forensic audit after noticing unauthorized withdrawals from its bank accounts. Forensic auditors analyze transaction histories, internal controls, and financial systems to uncover fraud or misreporting.

Businesses often turn to audit firms like Premier Auditing & Accounting, with specialized forensic teams to handle these fraudulent cases.

7. Information System Audit

As businesses increasingly rely on technology, information system audit has become vital. Information System Audit focuses on evaluating IT infrastructure, data security, and system reliability.

Focus Areas for Information System Audit

- Ensuring cybersecurity and protecting sensitive data

- Assessing compliance with data privacy regulations like GDPR or HIPAA

- Identifying inefficiencies in IT operations

For instance, a financial institution may use an information system audit to verify that it’s online banking platform is secure from cyber threats. Auditing firms like Premier Auditing & Accounting, bring specialized knowledge in IT systems, helping businesses enhance their digital resilience.

What Matters Concern Choosing Right Audit Services

It is essential to comprehend the common types of audit services as companies want to achieve better financial reporting, ISO or ICV certifications, and reporting on business specific matters.

Each audit type aims to cater business specific needs, ranging from fraud detection to compliance and control.

Here’s why businesses should undertake audit

- It protects against financial and operational risks

- It keeps up with the ever-changing legal requirements

- It helps create credibility and confidence among investors, creditors and customers

Outsourcing these audits with expert auditors, like Premier Auditing & Accounting, helps to achieve accuracy of the financial information, mitigate potential risks, best regulatory compliance and optimal confidence of the stakeholders.

Thanks to choosing perfect audit partner, like Premier Auditing & Accounting, who can assist organizations in identifying the right form of audit which suit their objectives for long-term sustainability. Specifically, through the provision of suitable services, the business owners can effectively manage challenges and enhance operational performance for sustainable growth.