Exploring the Importance of Accounting for Corporate Tax

Recently, the United Arab Emirates Government introduced a corporate tax regime at a 9% rate for income over AED 375,000. This new imposition of corporate tax brings along challenges of compliance and strategy to companies that are included in the tax bracket. In addition, the FTA requires corporations to maintain records that are IFRS-compliant for ease of international trade. Thus, a corporate tax accountant is an important position in such businesses, helping them maintain compliance standards.

However, the importance of business accounting is not limited to compliance and tax submission. Corporate tax services in the UAE can help a business maintain optimum cash flow and implement effective tax strategies for supported growth. Let’s take a look at the importance of auditing and accounting in the UAE and the services included.

Role of Corporate Tax Accounting

Corporate tax accounting involves the processes of preparing, recording, and reporting a firm’s taxable income as per UAE corporate tax requirements. With corporate tax being brought into the UAE, businesses should take structured account practices to get through the laws while maximizing their tax efficiency.

Small-scale businesses or huge corporations can obtain assistance from accounting firms in Dubai for the management of tax, wherein the services include

- Keeping the record and bookkeeping

- Tax calculation and filing

- Regulatory compliance and free zone benefits

- Optimizing tax liabilities and financial decision-making

- Tax planning and strategy

Corporate tax accounting helps businesses follow tax regulations, optimize their financial performance, and maintain transparency, highlighting the importance of accounting firms. The expertise of accounting firms makes it easy for businesses to adhere to tax laws, explore the possibility of tax savings, and avoid non-compliance risks. Professional advice enables businesses to grow while meeting tax obligations effectively.

The Importance of Corporate Tax Accounting for Business Growth and Stability

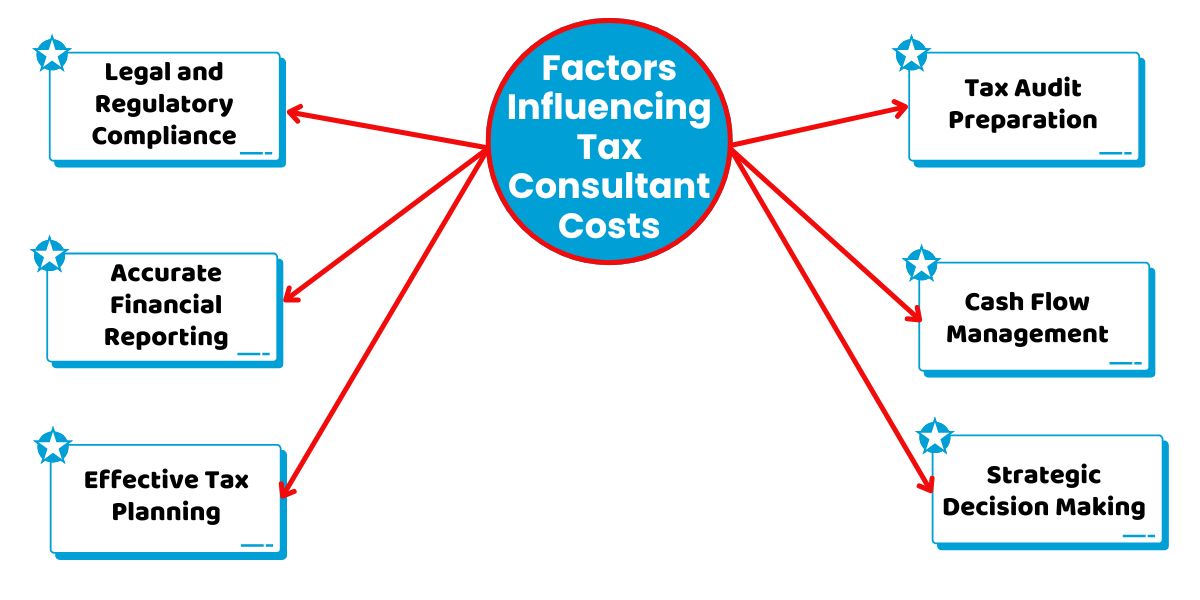

Legal and Regulatory Compliance

The importance of accounting pertains to legal and regulatory compliance. The first thing is tax compliance. The Federal Tax Authority sets rules and regulations which force businesses to

- File tax returns accurately

- Keep proper documents

- To be on time to avoid penalties

With effective corporate tax accounting, your business will be able to stay compliant with these legal requirements and avoid fines and legal issues. Moreover, staying compliant with the local corporate tax laws can help enhance your reputation as a growing business.

Accurate Financial Reporting

Corporate tax accounting plays a vital role in maintaining transparency in your financial records. In the UAE, where investors and global partners often scrutinize businesses, accurate financial reporting builds trust and credibility.

By aligning your financial statements with tax obligations

- You can present a clear picture of your business’s profitability

- You’ll be prepared for audits and assessments by the FTA

- You enhance stakeholder confidence, which is crucial for attracting investments

The best accounting firms in Dubai can take charge of accurate financial reporting and help create detailed records of your financial transactions. This helps maintain transparency for regulatory compliance as well.

This helps to integrate all the information concerning the finances of the company into one book. It thus allows business persons to see where they stand regarding their finances. A reliable accounting system also prevents fraudulent practices by transparently showing every transaction you make.

Effective Tax Planning

One of the key benefits of corporate tax accounting is its role in tax planning. Companies in the UAE can tactically formulate their tax liabilities through the various exemptions offered by the FTA within the tax framework.

This includes the different benefits for Free Zone businesses and relief for small businesses and start-ups. By strategically planning your tax obligations, you can reduce unnecessary costs and reinvest savings into business growth initiatives.

This is supported by efficient accounting that gives a bird’s eye view of your income and expenditure, helping highlight different opportunities for optimum tax savings.

Tax Audit Preparation

Accounting is important in small businesses, as it also involves preparing for a tax audit by the FTA. Tax audits are one of the integral aspects of the corporate tax system implemented by the UAE. Businesses must be ready with proper records and documentation to prove compliance.

Corporate tax accounting will ensure you keep a record of all income, expenses, and deductions that your business incurs. In addition, accounting will allow you to keep a record that can back your tax filings.

Cash Flow Management

Every business needs cash flow management for optimal liquidity. By recording financial transactions, you are able to know the inflows and outflows of cash in your business and understand your financial position.

This will help you strategize your transactions better to maintain the required cash flow. In addition, accounting can also help discover potential problems and guide planning for future growth. Therefore, cash flow management is not only about bookkeeping but it’s about knowing the financial health of your business and using it in decision-making.

Strategic Decision Making

Corporate tax accounting is not just about routine compliance with the books. It’s something that has far-reaching powers behind it. By understanding your tax obligations and strategically managing them, you can create a solid foundation for your business’s future.

Your financial statements can provide the necessary advice to prepare business strategies and plan for the future. This means finding out trends and patterns from the statements so that the company can anticipate future problems and opportunities.

In addition, a proper record of your finances acts as a key tool for potential stakeholders to analyze the business’s viability. In that case, having a clear and transparent accounting system will aid investor confidence.

How Accounting Makes Corporate Tax Management Easier

As corporate tax becomes an integral part of the UAE’s economy, businesses need to focus on proper tax accounting in order to remain compliant, financially sound, and strategically prepared. Whether it is maintaining accurate records, optimizing tax savings, or preparing for audits, corporate tax accounting plays multiple roles in a business’s optimum working.

A top accounting firm like Premier Auditing & Accounting will be of great help in taking the best possible tax accounting practices into a business. By doing so, you not only ensure legal compliance but also strengthen your position in the market.