What You Need to Know About Company Liquidation in Dubai?

Closing a business in Dubai can be just as important as starting a new one. Company liquidation in Dubai is the lawful process of winding up a company and closing its operations. It entails paying debts, distributing assets, and revoking licenses to comply with UAE regulations. Familiarity with the company liquidation process in Dubai is required for company owners to prevent legal or financial repercussions. Voluntary or Compulsory winding up can be done for companies based on their financial status and regulatory compliance.

Legal liquidation avoids potential liabilities and leads to a successful exit. Consulting professionals, from best audit firms like Premier Auditing and Accounting LLC, can ease the process of business liquidation and make sure that it is legally compliant. This article is a step-by-step walkthrough of the procedure of company liquidation in Dubai, what has to be done, legalities, and points to consider by entrepreneurs.

What is Company Liquidation?

Company liquidation is the procedure for closing a business by paying off its debts, dispersing the assets, and legally closing its operations. Successful closure of a company guarantees fulfillment of UAE laws, prevents legal problems, and upholds stakeholders’ interests. Adhering to the company liquidation process in Dubai in a proper way and seeking expert help can make business closure easy and effective.

Liquidation of companies in Dubai can also be of two types

Voluntary Liquidation – Performed by shareholders when they decide to wind up the company.

Compulsory Liquidation – Carried out by the government when a business is either insolvent or if there is default in regulations.

Why Liquidate a Company in Dubai?

1. Insolvency

The company could be liquidated when it’s unable to continue with its finance requirements or discharge current debts. Here, liquidation settles down obligations and avails a controlled exit, hence preventing legal complications against business entrepreneurs.

2. Business Restructuring or Closure

Businesses can choose liquidation if their business model or operations are unsustainable, or they intend to restructure under a new company. It enables them to shut down ongoing operations smoothly and begin a new if necessary.

3. Legal or Regulatory Non-Compliance

Violation of UAE business laws, such as licensing rules or tax requirements, can lead to serious problems. Following the legal requirements helps businesses avoid penalties and continue operating smoothly.

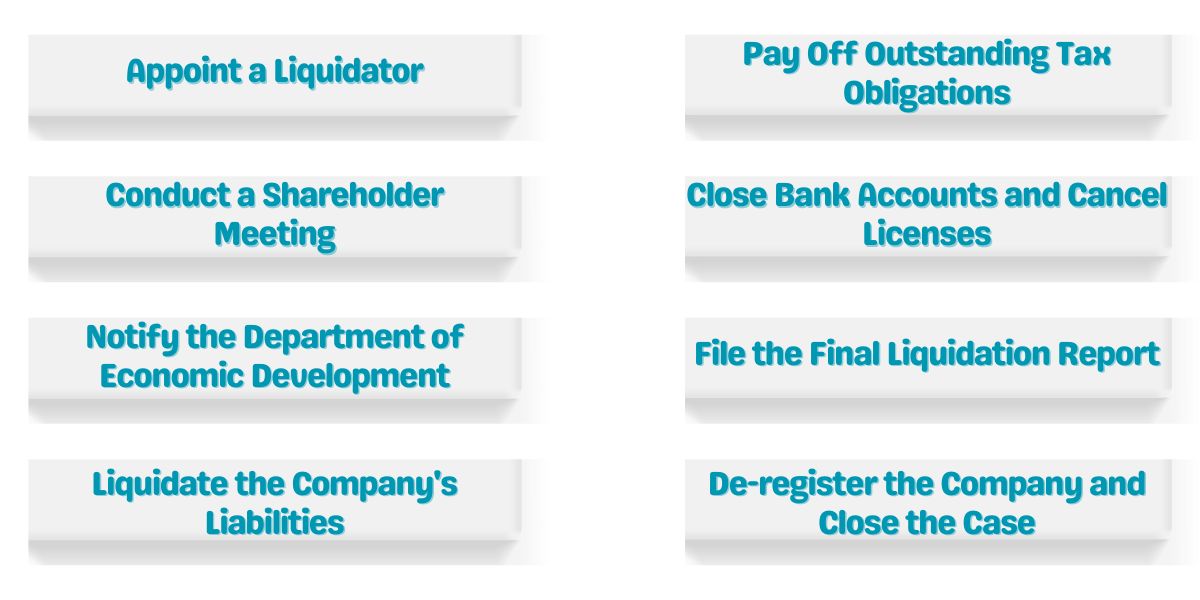

Dubai Company Liquidation Process Step-by-Step

Dubai company liquidation undergoes a systematic procedure to observe laws and facilitate effective closure. Business owners have to undertake necessary steps to close debt, inform authorities, and deregister the firm.

Step 1: Appoint a Liquidator

The first step is hiring a licensed liquidator, typically an audit firm, to oversee the process, ensure compliance, and prepare the final liquidation report. The liquidator’s appointment must be officially documented and submitted to the licensing authorities.

Step 2: Conduct a Shareholder Meeting

Shareholder resolution is required to be passed for the approval of liquidation. The resolution must include the liquidator appointed and be notarized prior to submission to the Department of Economic Development (DED) or the concerned free zone authority.

Step 3: Notify the Department of Economic Development (DED)

Dubai Mainland-registered companies need to inform the DED, and free zone business enterprises need to report to the relevant free zone authorities. Doing so will ascertain that the liquidation follows the proper regulatory guidelines.

Step 4: Liquidate the Company’s Liabilities

All obligations, employee wages, and financial liabilities have to be paid off before moving on. If necessary, the assets of the company can be sold to pay for outstanding payments to creditors, employees, or suppliers. Outstanding liabilities can result in legal repercussions.

Step 5: Pay Off Outstanding Tax Obligations

Businesses are required to pay off all tax debts prior to liquidation. These include filing of final tax returns to the Federal Tax Authority (FTA), de-registration of VAT & CT and remitting any remaining tax dues in order to circumvent future judicial penalties.

Step 6: Close Bank Accounts and Cancel Licenses

All corporate bank accounts should be closed, and licenses to be cancelled. Businesses need to notify their banks and respective licensing authorities ahead of time.

Step 7: File the Final Liquidation Report

When all the financial settlements and regulatory obligations are completed, the liquidator makes a final report outlining the liquidation process, tax settlements, and compliance information. The report is to be filed with the DED or free zone authority for approval.

Step 8: De-register the Company and Close the Case

On approval, the company’s registration is officially cancelled, marking the completion of the liquidation process. Then the company gets legally dissolved.

Role of Audit Firms in the Liquidation Process

Audit firms are responsible for undertaking a hassle-free and legal compliance for Dubai company liquidation process. They assist companies by performing financial audits, settling outstanding tax dues, and taking care of compliance procedures. The best audit companies in Dubai like Premier Auditing and Accounting LLC, offer professional advice to reduce legal complications and avoid penalties. Hiring a professional auditing company guarantees a smooth business liquidation, a hassle-free shutdown, and the safeguarding of the interests of the shareholders and the business owners.

Key Considerations During the Liquidation Process

1. Costs

Dubai company liquidation entails a number of charges, which comprise government approval fees, audit reports, and legal costs. Additionally, entrepreneurs must budget for these fees to make it simple to liquidate the business.

2. Timeframe

The liquidation procedure would take between 2 to 6 months, based on the company’s financial position, compliance with regulators, and prompt submission of documents. The procedure is delayed where there are pending liabilities or judicial issues.

3. Legal Implications

Shareholders and directors are held accountable for settling all legal and financial obligations. Failure to settle debts, close trade licenses, or comply with requirements may result in penalties, legal proceedings, or prohibition from future business activities in the UAE.

Smooth Company Liquidation Process in Dubai

Adhering to the proper company liquidation process in Dubai is important for a smooth and legally compliant shutdown. Business owners should go through each step closely, from the appointment of a liquidator to settlement of liabilities and cancellation of licenses. Hiring qualified auditors like Premier Auditing and Accounting LLC will make the process smoother and provide adherence to UAE legislation. Being prepared at the right time and following the rule of law averts delays and fines. Consultation with professional experts ensures seamless liquidation of the business, facilitating the closure of business operations with efficiency while all the financial as well as legal liabilities are complied with, shunning future burdens and safeguarding stakeholders’ interest.