A Guide to Business Set Up Costs in Dubai, UAE

Dubai’s strategic location, robust infrastructure, and business-friendly environment make it a hotspot for entrepreneurs and investors worldwide to start their business. However, appropriately setting up a business from day one requires understanding the cost involved.

Start-up costs for a business in Dubai generally range from AED 5,500 to AED 25,000, depending on the type of business, location, license, and other requirements. This blog gives you a clear view of company formation cost in Dubai, including factors and cost breakdowns.

Breakdown of Company Set Up Costs in Dubai

For effective planning, it is essential to know the details of the expenses of company formation cost. This section breaks down the business set up cost in Dubai into key areas – to give entrepreneurs a clear indication of the amount to budget for.

[ninja_tables id=”7007″]

Above, we provided an approximation for company set up costs in Dubai mainland and in free zone. However, there are additional costs to be incurred for office rent (if you need physical office), employee visa cost and external authority fees depending on business structure, location, and licensing authority, so understanding costs will help you budget properly.

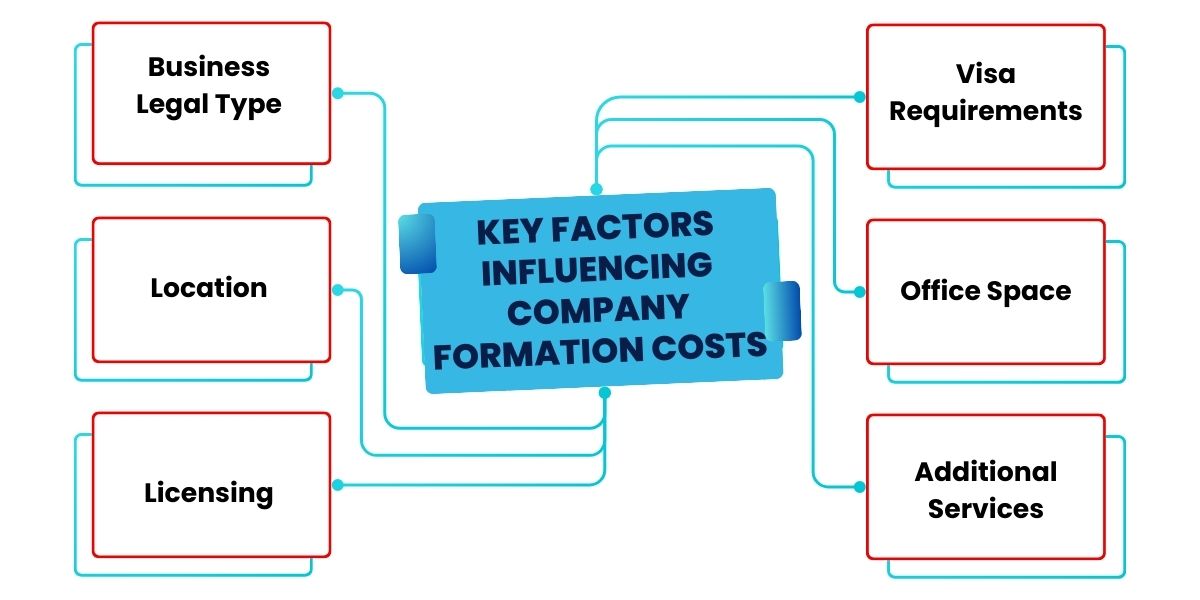

Key Factors Influencing Company Formation Costs

Several factors contribute to deciding the overall cost of company formation in Dubai and directly influence the budget and business set up requirements. Healthier financial planning and smoother operations become possible as these factors are understood better.

1. Business Legal Type

Registration costs depend on your chosen business structure, such as a Mainland Company, Free Zone Company, or Offshore Company. The mainland license may require office/warehouse spaces and external authority approvals for some type of businesses. However Free Zone company processes tend to be simpler but have limitations regarding business activities.

2. Location

Your business location heavily influences company setup costs. Tax benefits and easy setup make the free zones popular, while mainland setup is favoured for its flexibility in operating across the UAE. However, mainland businesses involve higher costs, including office rent, employee visa cost, and it is necessary to get external authority approvals for professional licenses.

3. Licensing

A large portion of the business setup cost depends upon the type of trade license: commercial, professional, or industrial. The fees for each license are based on the type of business activities. Specialized businesses may also need additional permits or approvals.

4. Visa Requirements

The residency visa for employees and investors drives costs. Government fees, medical tests, and stamping charges are added, making visa processing one of a business’s most considerable set up costs in case of mainland businesses.

5. Office Space

Many businesses need office space and security. Total costs by renting physical offices, which businesses outside free zones have to do, increase significantly compared to free zones offering flexible workspace options.

6. Additional Services

Service oriented businesses such as legal advisory, health care, auditing, bank and insurance require more compliances from concerned regulatory authority. Incorporate your business through reputable consulting firms like Premier Auditing and Accounting as they add value to your business set up by ensuring financial accuracy and regulatory compliance. By focusing on these things, you can gauge and better set your company formation cost in Dubai.

Hidden Expenses in Company Formation Cost

The major company formation cost in Dubai, such as licensing fees, office rent, and visa expenses, are all well known, but several other expenses, which entrepreneurs may overlook when setting up, are also worth mentioning. Unless planned for, these costs can quickly add up on an individual’s budget.

1. Renewal Fees

Annual renewal fees, which include renewing trade licenses, external authority fees, and office leases, are among the most often overlooked fees. Sure, the initial setup costs could be manageable, but you must consider the recurring costs to ensure you are not financially stressed.

2. Advisory Fees and Professional Services

Many businesses require the employment of legal and financial professionals, such as lawyers, accountants, and auditors. Complying with local regulations requires hiring professional services. Still, additional costs to be added when a business deals with complexities such as international and foreign investments.

3. Marketing and Branding Costs

Dubai is a competitive place to establish a business, and marketing is crucial for success in business and powerful brand presence. Designing a logo takes its amount, as does developing a website, creating promotional materials, and running marketing campaigns. All of these factors will significantly increase the business set up cost.

4. Insurance and Liability

Some industries need specialized insurance, like professional indemnity or general liability insurance. The nice thing about these policies is that they protect your business from potential risk and legal issues, but they also come with additional premiums to find, so they make sense.

5. Miscellaneous Administrative Costs

Administrative expenses like document translation, notary services, and PRO (Public Relations Officer) services can be additional for some kind of businesses. These services help your business maintain good contact with authority and other regulatory body.

By precalculating these hidden costs and partnering with experts such as Premier Auditing and Accounting, businesses can ensure that they won’t be caught off guard and keep their company formation costs in check.

Making Smarter Decisions for Start-up Costs

Opening a business in Dubai is an incredible prospect, yet managing the start-up costs for a business expertly requires attentive planning and professional direction. Every decision will relate to your budget, from choosing the right location to determining the hidden expenses.

With a trusted business setup consultant like Premier Auditing and Accounting, ensure you get end-to-end help. Their experience in compliance, auditing, and business setup services in Dubai can make the process smoother and save you some ‘unnecessary’ costs.