Exploring the Benefits of Corporate Tax Registration in UAE for Business Growth

Corporate tax implementation in the UAE represents a remarkable economic shift that brings UAE tax policies to international standards without compromising its position as a global business centre. Starting June 1, 2023, corporate establishments in the UAE must register for corporate tax through mandatory procedures, which companies comprehend for successful business operations in this dynamic marketplace.

Therefore, this move not only ensures that they abide by the new regulations but also reaps many benefits that come with the position of being a corporation in the Middle East business environment. This article showcases the benefits of corporate tax registration in Dubai that can enhance a firm’s progress.

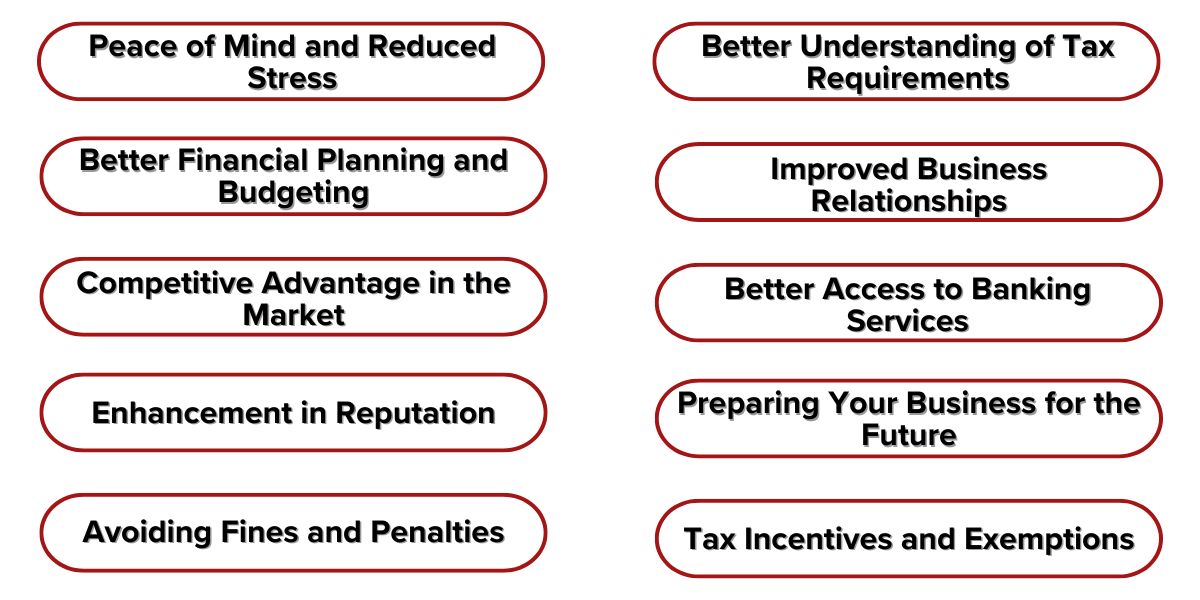

Benefits of Corporate Tax Registration

Auditing and Tax consulting firms in Dubai provide various services meant to assist companies in mastering challenging tax matters, such as

- Registration and Compliance Support: Help with tax registration, deregistration, and annual compliance requirements.

- Tax Planning and Advisory: Provide advisory on tax optimization, exemptions, and international tax implications.

- audit or dispute Representation Services: Preparing tax data for the Federal Tax Authority (FTA) during an audit or dispute.

Let’s discuss the various benefits of corporate tax registration

1. Peace of Mind and Reduced Stress

- Early corporate tax registration gives businesses peace of mind since they will not face the stress caused by hurried compliance processes.

- Companies should have sufficient time to obtain the required documents, make sure all data is correct, and solve unforeseen problems that might appear when registering.

2. Better Financial Planning and Budgeting

- The process of early registration provides businesses with better financial management capabilities.

- The early knowledge of tax responsibilities enables companies to make precise tax payment projections, which leads to better financial cash flow planning and tax fund allocations.

- Using this approach, business owners can prevent unexpected financial situations and make wiser investments.

3. Competitive Advantage in the Market

- Suppliers prefer to make business connections with Corporate tax registered entities. It helps to maintain healthy business relationships among themselves.

- Banks and other financial institutions trust tax registered entities for loan proceedings which might help businesses to attain their growth.

4. Enhancement in Reputation

- A company that registers for corporate tax first establishes both professionalism and financial commitment toward compliance with rules.

- The enhancement of company reputation allows businesses to gain more appeal among partners, clients, and competitors since large corporations and government entities focus on tax compliance.

5. Avoiding Fines and Penalties

- UAE enforces severe financial consequences for breaking its tax regulations.

- Businesses that initiate early registration prevent themselves from encountering fines due to late registration that safeguard their financial stability and professional reputation.

6. Better Understanding of Tax Requirements

- Early commencement of tax registration enables organizations to master tax laws and necessary regulations.

- A business requires proper accounting systems training, participation, and internal tax management procedures to establish effective tax management.

7. Improved Business Relationships

- A company that registers for taxes early builds improved relationships with stakeholders through its transparent, professional tax management system.

- Organizations enjoy better trust relationships alongside better future business readiness.

8. Better Access to Banking Services

- Tax-compliant businesses earn better banking service quality by fulfilling tax requirements, thus qualifying easily for loans and obtaining favorable financial product rates.

- If the companies register earlier, it will strengthen bank relations and create a favorable credit record.

9. Preparing Your Business for the Future

Your organization needs to develop a strategy for future readiness. Businesses that pursue early registration prepare themselves for upcoming changes for the present and future market expansion. This proactive approach helps businesses to

- Adapt to new regulations by staying updated with legal changes to maintain ongoing compliance.

- Have readiness that enables your business to maintain superior industry performance against competitors.

- Establish a culture that promotes lawful conformity for employees.

- Develop strategies that allow businesses to achieve their expansion goals within new markets.

10. Tax Incentives and Exemptions

The corporate tax services in the UAE offer various tax advisory on incentives and benefits, especially for Free Zone businesses, such as

- The Free Zone and the business activities determine whether a company qualifies to pay 0% corporate tax or enjoy lesser tax rates based on the Free Zone regulations.

- Obtaining a Tax Residency Certificate serves multiple purposes in international financial operations and investment activities.

- Businesses need to benefit from available tax deductions to minimize their tax expenses, and recognizing qualified deductions significantly lessens their tax burdens.

For more information on the advantages of corporate tax registration and compliance, visit the Federal Tax Authority.

As we have gone through the benefits of tax registration, corporate tax planning is also an important part of the process.

One of the benefits of corporate tax planning is that it provides businesses in Dubai with multiple advantages. The optimization process creates reduced liabilities combined with increased cash flow, which enables the companies to reinvest for growth purposes. Businesses operating in Dubai benefit from the low corporate tax rate of 9% because it helps them to get benefited from the increased retained earnings. Firms operated within free zones qualify for substantial company tax benefits that provide corporate tax exemption.

A well-designed tax strategy helps organizations abide by the regulations that prevent them from facing financial penalties. Businesses using these benefits will gain competitive advantages that enable sustainable growth within Dubai’s evolving economy.

Tax Compliance as the Smart Move for Businesses in Dubai

Auditing and Tax consulting firms in Dubai provides services related to registering for corporate taxes that meets the company’s regulatory needs and a set of advantages that strengthen financial stability, business reputation, and competitive marketability.

A business gains maximum tax benefit from its strategies and reduces risks through corporate tax planning and auditing services while creating lasting advantages. The UAE’s status as a global business hub demands that business organizations consider these opportunities for their continued market success.

Premier Auditing and Accounting LLC provides comprehensive assistance for Dubai companies seeking help from corporate tax registration and planning services. Our business-oriented services help clients handle the UAE tax system efficiently while maintaining full compliance and extracting maximum financial benefits for their organization.