What You Need to Know About Accounting Services Costs?

Are you aware that 82% of companies face difficulties in financial management due to mishandling of accounts? Many firms around Dubai may not see how helpful skilled accounting could be—that is until serious financial issues arise for them. The main question to ask is: What are the advantages of outsourcing accounting services in Dubai, and is it worth it for such an investment?

A small business managing little more than routine bookkeeping and VAT filings requires a well-organized accounting system to ensure smooth financial operations. But as a business grows, so does its financial footprint. Larger companies, with intricate financial structures and strategic decision-making at play, must invest in robust financial management to sustain growth and compliance.

In this blog, we’ll comprehensively break down multiple accounting services available, comparing in-house vs oursource services, as well as examining components that affect service requirements.

The Importance of Professional Accounting

A business’s financial health depends on accurate bookkeeping, tax compliance, and strategic financial planning. Accounting services go beyond simply tracking income and expenses—they help businesses

- Ensure compliance with UAE tax regulations, including VAT and Corporate Tax.

- Improve financial decision-making through detailed reporting and analysis.

- Reduce the risk of penalties due to incorrect tax filings.

- transactions efficientl Manage payroll, invoicing, and other financial transactions efficiently.

For businesses in Dubai, where complex business models exist, having a professional accountant can be the difference between success and failure.

Types of Accounting Services Available in Dubai

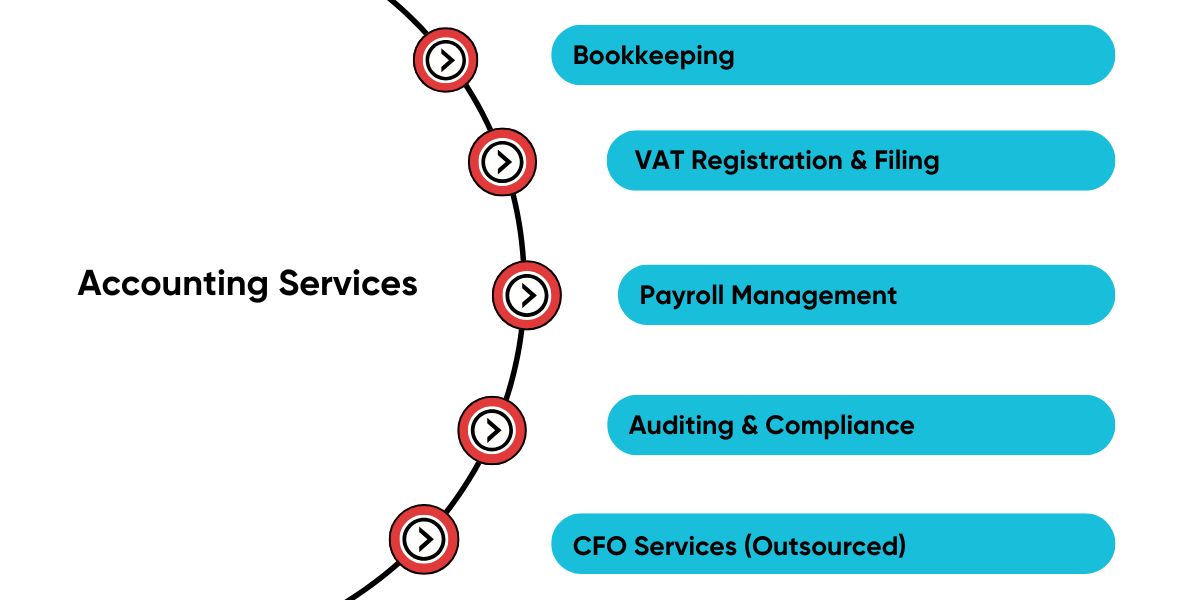

Accounting services vary depending on a business’s size, industry, and financial complexity. Some of the most common services include

1. Bookkeeping

This involves recording financial transactions, reconciling bank statements, and preparing financial reports. Bookkeeping ensures that a company’s financial data is up-to-date and accurate.

2. VAT Registration & Filing

Since VAT was introduced in year 2018 in the UAE, businesses earning above the threshold must register and file VAT returns regularly. Professional accountants help ensure compliance and minimize errors in tax reporting.

3. Payroll Management

Handling employee salaries, benefits, and tax deductions requires precision. Payroll services ensure that salaries are processed on time while adhering to UAE labour laws.

4. Auditing & Compliance

Businesses must conduct internal and external audits to comply with UAE financial regulations. Auditors examine financial records to verify accuracy and prevent fraud.

5. CFO Services (Outsourced)

For growing companies that need financial leadership but cannot afford a full-time Chief Financial Officer, outsourced CFO services provide strategic financial planning and risk management.

Outsourcing vs. In-House Accounting Which is Better?

One major decision business owners face is whether to hire an in-house accountant or outsource accounting services. Let’s compare both options

1. Hiring an In-House Accountant

- Full control over financial operations.

- A fixed salary of AED 4,000 – 8,000+ per month.

- Additional costs for visas, employee benefits, health insurance, and office space.

- Suitable for large businesses with complex financial needs.

2. Outsourcing Accounting Services

- Pay only for what you need—ideal for small and mid-sized businesses.

- More affordable than hiring a full-time employee.

- Access to highly experienced accountants and tax professionals.

- No additional costs for office space or employee benefits.

For businesses looking for cost-effective solutions, outsourcing is usually the smarter choice.

What Influences the Cost of Outsourcing Accounting Services?

Even with outsourcing, the accounting services in UAE significantly change based on various elements. The following are elements that influence the cost of accounting services.

1. Business Size and Complexity

A simple trading firm, along with only few transactions each month, will have lower accounting costs than a multinational firm, in addition to thousands of transactions from cross-border tax obligations, as well as from regulatory requirements.

2. Type and Frequency of Service

Some businesses need only occasional bookkeeping service, while others require full-time accounting support. Costs increase with frequency

- One-time services (like Backlog accounting, VAT registration or company audit) have a fixed price.

- Weekly, Monthly or yearly accounting (like bookkeeping and payroll) is billed on a recurring basis.

3. Industry-Specific Accounting Needs

Certain industries have unique accounting requirements. For example

Real estate companies need escrow account management and regulatory compliance.

- E-commerce businesses deal with payment gateway reconciliations.

- Manufacturing firms require complex inventory and cost accounting.

The more specialized the accounting needs, the higher the cost.

4. Experience and Reputation of the Accounting Firm

Larger and well-established accounting and auditing firms charge notably higher fees, and they also provide better expertise, risk management, and compliance assurance. Smaller firms or freelance accountants may offer lower prices but might lack experience with complex financial structures.

For instance, a reputable accounting firm could charge AED 6,000 monthly for a completely all-embracing financial package. A smaller firm may offer that same exact package for AED 3,000 monthly.

Hidden Costs to Watch Out for

While outsourcing accounting services is cost-effective for them, there are still a few of the costs that businesses should be aware of it

- VAT Filing Sanctions – Inaccurate submissions or delayed submissions may cause more fines. Guarantee that your accountant always files each of the documents in a punctual manner.

- Extra Consulting Fees – A few firms bill separately for guidance on taxes, business shifts, or consulting aid. Those services might not be part of typical arrangements.

- Accounting Software Costs – If your business requires software like Zoho, QuickBooks or Xero, there might be setup and subscription fees.

To avoid surprises, always discuss pricing structures upfront and request a detailed service breakdown before signing any contract.

Is Accounting an Expense or a Smart Investment?

Accounting services costs in Dubai change based on what a business requires, ranging from AED 1000 each month for simple record-keeping to more than AED 50,000 annually for handling finances. Outsourcing is virtually the optimum solution for quite a few businesses if they are in search of accounting services that are affordable and reliable yet the best auditing services in Dubai.

If your business requires outsourced accounting and financial advisory services, Premier Auditing and Accounting LLC provides expert service with affordable pricing. We offer expertise financial advisory services help to keep your firm working without any issues, whether you want help with accounting, VAT submissions, pay management, or reviews.