Why an Anti Money Laundering (AML) Audit Is Essential for Modern Businesses?

In today’s highly regulated financial environment, companies must abide by strict compliance guidelines. An Anti-money laundering (AML) audit is a valuable tool for ensuring that companies, especially those in the financial and professional services sectors, comply with the law, by prohibiting and identifying illegal financial transactions, assessing risk, ensuring transparency & enhancing regulatory accountability.

Whether your company handles higher volume of financial transactions, be it a bank, consulting business, or some other business, having knowledge of the technical aspects of an anti-money laundering audit will be helpful.

What is an Anti Money Laundering (AML) Audit?

An AML audit is a comprehensive review of anti-money laundering systems, procedures, and practices in an entity. Its intention is to verify whether the entity is adhering to the legislative guidelines and if its internal control measures can detect and prevent activities of money laundering. The audit also examines at how well employees are trained to spot and respond to suspicious activity, whether records are being kept accurately and thoroughly, and how quickly and effectively the organization addresses potential risks.

Why AML Audits are Essential for Businesses?

Non-compliance can lead to severe fines, reputational damage, or even company closure as authorities tighten anti-money laundering policies. Anti-money laundering audits are about protecting your company and stakeholders against systematic financial crime, not so much box-ticking.

Having an anti money laundering (AML) audit offers most essential benefits as follows

- Ensuring regulatory compliance

- Minimizing operational and reputational risk

- Building trust with clients and regulators

- Enhancing internal governance

- Identifying weaknesses in AML controls

- Improving employee awareness and training

- Supporting due diligence and a risk-based approach

- Preparing for external inspections or investigations

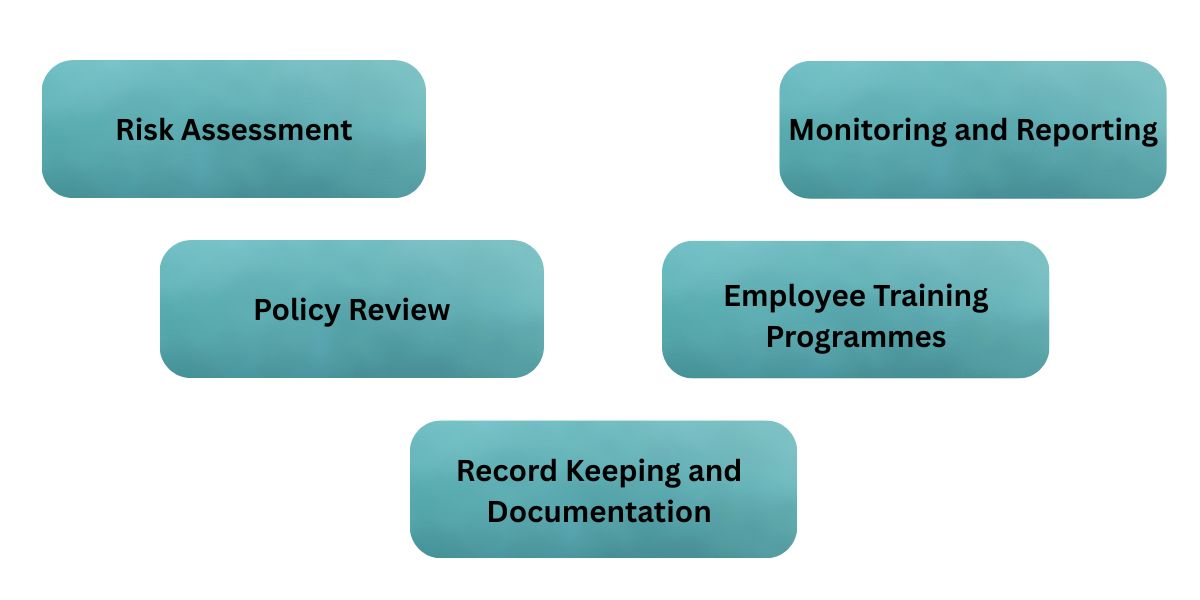

Key Elements of an AML Audit

A full AML audit involves the verification of various components of a company’s compliance regime, ensuring that policies, procedures, and controls are not only in place but also effectively implemented across all levels of the organization.

1. Risk Assessment

Audit staff start off by determining your organization’s exposure to risk on a geographic, customer, and transaction volume basis.

2. Policy Review

Auditors examine the AML policies, checking whether they meet local and international compliance requirements.

3. Monitoring and Reporting

Another key component of the audit involves verification of the monitoring of transactions and suspicious activities reporting to the authorities.

4. Employee Training Programmes

AML Auditing services also check whether your staff is adequately trained in AML processes and how frequently this training is updated.

5. Record Keeping and Documentation

Record management is crucial. An audit checks how customer identification and transaction-related data and records are kept.

How Often Should You Conduct an AML Audit?

Regulatory authorities recommend performing an AML audit on a yearly basis. The annual review guarantees that your AML policies, procedures, and systems are up to date with evolving regulatory needs. Frequency must not be a cookie-cutter approach—it depends upon your risk profile for your business.

Organizations that process large volumes of international transactions and work with politically exposed persons (PEPs) and operate in finance, real estate, and trade sectors are inherently more vulnerable. In such cases, audit frequency may need to be increased to a bi-annual or even quarterly basis.

AML Audit Checklist

This is what a standard anti money laundering audit entails

- Review of Know Your Customer (KYC) policies

- Assessment of transaction monitoring systems

- Evaluation of reporting practices for suspicious activity

- Validation of employee AML training records

- Testing the effectiveness of internal controls

Common Gaps Identified in AML Audits

Despite having internal AML policies and procedures, companies often fall short in the following areas

- Inadequate risk profiling

- Outdated AML policies

- Insufficient staff training

- Weak reporting mechanisms

- Poor internal coordination

Identifying these early can help your business avoid severe penalties.

Regulatory Framework for AML in Dubai

UAE has a strong anti-money laundering (AML) system based on international standards, led mainly by the Financial Action Task Force (FATF). Key regulations include Federal Decree-Law No. 20 of 2018 and its Executive Regulation (Cabinet Decision No. 10 of 2019), under which financial institutions and Designated Non-Financial Businesses and Professions (DNFBPs) such as Real Estate agents, Lawyers & Notaries, Accountants & Auditors, Trust & Company service providers and bullion dealers have to implement risk-based due diligence, maintain appropriate records, and report suspicious transactions to the UAE Financial Intelligence Unit (FIU).

Regulatory Compliance is enforced by the authorities, such as the UAE Central Bank and Ministry of Economy, to which firms are required to register on the goAML platform in order to enable real-time reporting. Non-compliance can result in severe sanctions, criminal prosecution, and loss of reputation. UAE’s regulatory measures are reviewed regularly under FATF’s mutual evaluations to verify improved overall compliance.

Who Needs an AML Audit in Dubai?

The following industries are especially recommended to undergo regular AML audits

- Financial Institutions

- Real Estate Agencies

- Law Firms & Notaries

- Accounting & Auditing Firms

- Trust & Corporate Service Providers

- Jewellery and Precious Metals Traders

If you belong to such an industry, an anti-money laundering audit helps you stay compliant. Using a trusted auditing service in Dubai ensures full regulatory alignment.

Best Practices for AML Compliance

To strengthen your AML programme, follow these best practices

Update risk assessments regularly: Align your AML strategy with changing customer profiles, geographies, or services.

Run ongoing employee training: Keep teams alert to new red flags, procedures, and regulatory changes.

Use AML monitoring tools: Automate alerts, spot anomalies faster, and reduce manual errors.

Engage expert auditing services: Firms like Premier Auditing and Accounting LLC provide precision, insight, and compliance confidence.

Stay connected with regulators: Proactive communication helps you adapt quickly to evolving guidelines.

Future Proofing Compliance with AML Audits

An AML audit is not only a regulatory issue-it’s a badge of honor for a company’s dedication to responsibility, transparency, and long-term sustainability. As financial crimes continue to evolve and become more complex, companies must keep up with that speed with equally nimble compliance measures.

Staying ahead requires the right partners and processes. Dealing with seasoned audit companies in Dubai, such as Premier Auditing and Accounting LLC, allows entities to detect vulnerabilities in advance, strengthen internal controls, and get their anti-money laundering infrastructure compliant but solid and forward-looking.