Why Transfer Pricing Agreements Are Essential?

Did you know multinational firms represent about 60% of all global trade? Companies must handle complex tax regulations to avoid severe penalties for growing cross-border transactions. At this point, a guide on transfer pricing agreement is a necessity.

According to tax laws, a transfer pricing agreement ensures that transactions between associated companies follow equitable pricing processes to prevent profit shifting. Companies which fail to implement a transfer pricing agreement are more likely to attract tax audits and have higher risk of financial losses and legal consequences.

In this comprehensive guide, we will introduce you to transfer pricing agreement, its key elements, compliance issues, challenges involved, and best practice measures to ensure that you operate compliantly.

What is a Transfer Pricing Agreement?

A transfer pricing agreement is a contractual agreement that specifies the price of transactions between related entities, such as affiliates, subsidiaries, etc. To comply with the ‘arm’s length principle,’ the price is calculated as if the concerned companies are unrelated. This is intended to ensure that any intercompany transaction, such as the exchange of products or services, intellectual property, or finance, is by the applicable tax law.

The transfer pricing agreement also offers a mechanism for establishing price procedures, benchmarking the established prices, complying with tax authorities, and resolving disputes.

Companies without a well-organized transfer pricing agreement face legal scrutiny, tax audits, monetary fines, and reputational damage. An explicit agreement facilitates transparency, regulatory compliance, and fair taxes in multiple countries.

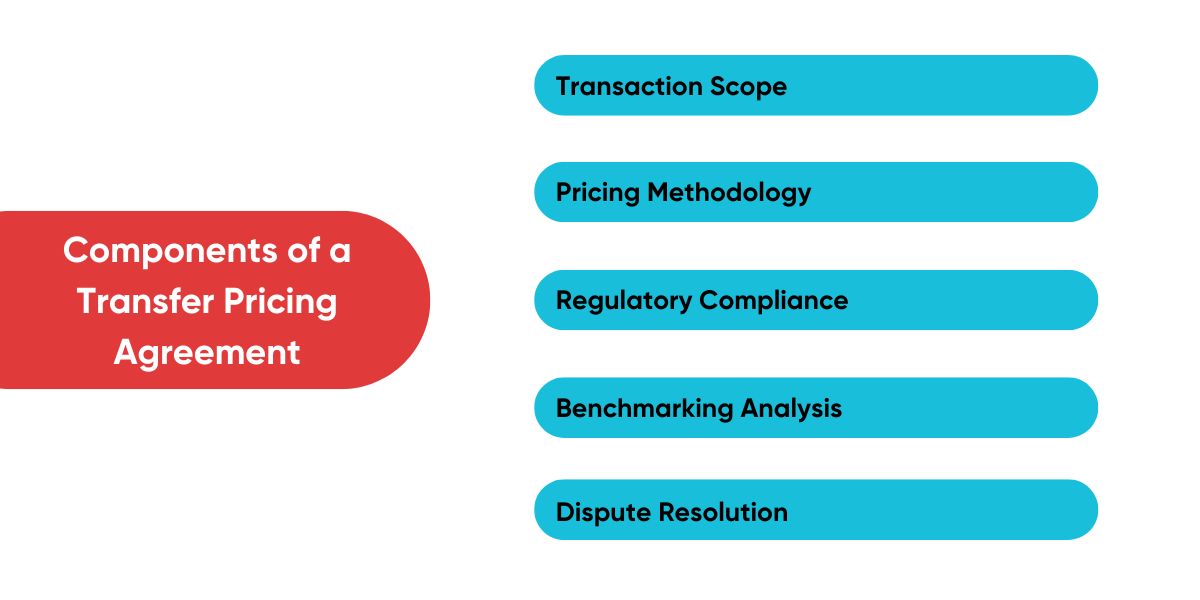

Key Components of a Transfer Pricing Agreement

A transfer pricing strategy should have certain key elements to be transparent and compliant. To ensure fairness, the price policy, benchmarking factors, and scope of transactions must be detailed. The strategy must also abide by foreign taxation laws to mitigate risks and avert legal consequences.

Here is a table setting out the crucial elements of a transfer pricing agreement

[ninja_tables id=”7213″]

All these elements facilitate equitable intercompany transactions to avoid tax evasion. Further, a properly worded transfer pricing agreement helps maintain regulatory conformity and fiscal accuracy among countries.

Compliance and Regulatory Considerations

Businesses must comply with global regulations and tax laws to avoid legal complications. Violations may lead to fines, heightened scrutiny from the tax agency, and reputational damage. Recordkeeping and staying informed of tax law evolution are all part of managing risk and maintaining trouble-free operations.

Corporate tax services help to ensure compliance in following

OECD Guidelines

Businesses must make their transfer pricing arrangements conform to the OECD’s arm’s length principle.

Local Tax Laws

Various nations have unique regulations on transfer pricing.

Accurate Documentation

Detailed documents must be kept for taxation and audit purposes.

Auditing Services

Companies should conduct internal audits to verify their transfer pricing.

It’s not just a matter of obeying the law but also one of reducing the financial risks and business uncertainty. Non-compliance may result in tax fines, loss of business reputation, and economic loss.

Why Compliance Matters?

Compliance with transfer pricing rules is essential for companies to prevent legal problems and monetary fines. Let us find out why complying with regulatory standards is essential

- Prevents double taxation of businesses.

- Maintains equitable division of profits across subsidiaries.

- Reduces risk of audits and fines.

- Improves transparency and credibility with tax authorities.

By complying with these regulatory factors, companies can prevent legal issues and fines.

Common Challenges in Transfer Pricing Agreement and How to Overcome them

It may be challenging for businesses to establish a transfer pricing regime because dealing with intricate tax laws and compliance requirements across various nations can be daunting. Businesses that lack a systematic process may be penalized, audited, and experience business operation disruptions.

Below are some of the common challenges and solutions

Unpredictable Pricing Policies

All transactions should adhere to a uniform approach.

No Benchmarking Data

Utilize industry databases and experienced analysts’ estimates for reliable pricing.

Regulatory Changes

Keep abreast of new tax legislation to maintain compliance.

Tax Authority Disputes

Collaborate with corporate tax professionals to settle disputes.

Complex Intercompany Transactions: Streamline pricing arrangements and maintain accurate documentation.

Addressing Transfer Pricing

Disputes Transfer pricing disputes with tax authorities are common. To avoid risks, companies ought to

- Enter into advance pricing agreements (APAs) with tax governments.

- Keep detailed records of the pricing choices.

- Seek advice from tax experts like Premier Auditing & Accounting LLC.

Adapting to Global Regulatory Changes

The regimes concerning transfer pricing evolve constantly. Firms should

- Monitor international tax updates regularly.

- Join industry forums and discussions.

- Adjust agreements based on new tax policies.

Careful planning and constant monitoring are required to overcome the challenges.

Ensuring a Smooth and Compliant Transfer Pricing Strategy

A well-performing transfer pricing system is imperative to fiscal compliance and maximizing net worth of multinational businesses. Hiring professionals such as Premier Auditing & Accounting LLC can help to stay precise, compliant, and trouble-free. Firms can have a fair, open, and transparent pricing policy if they follow the suggestions in this guidebook on transfer pricing agreements. To improve their transfer pricing policy, companies must conduct internal audits occasionally to check compliance and potential risk areas.