Understanding the Tax Consultant Cost in Dubai

The world of taxes can appear intimidating, especially in the vast business community of Dubai UAE, where tax laws are complex and ever-changing. As a personal seeker of advice on tax or a business wishing to manage tax obligations much more effectively, your answer lies in hiring of a professional tax consultant in Dubai. However, a common question is: how much does a tax consultant cost?

In this blog, we’ll discuss various factors influencing how much a tax consultant costing you, a tax consultation breakdown of expenses on average, and additional fees that arise within the tax consulting services if you are looking for a reliable source of tax services.

Breakdown of Tax Consulting Fees by Service Type

Now that we have discussed the determinants of hiring a tax consultant in Dubai, let’s look at the figures. Knowing your service mandate is necessary to determine the exact figure. Still, we can provide you with an overview of what you expect with respect to the cost for tax consultation in Dubai.

Here’s a general breakdown of the cost of tax consultants in Dubai

| Service Type | Estimated Cost |

|---|---|

| VAT registration | AED 500 – 1000 |

| VAT return filing | AED 500 – 2000 |

| Corporate Tax registration | AED 500 – 1000 |

| Corporate Tax return filing | AED 1000 – 3000 |

| Corporate Tax Consultation | AED 2500 – 5000 |

| International Tax Consultation | AED 5000 – 10,000 |

As you have seen, fees for tax consultation in Dubai can vary by the nature of the service offered. Simple VAT consultation, for instance, may cost only a few hundred dirhams, whereas advice regarding Corporate Tax or International Tax need full-fledged tax planning may cost much more.

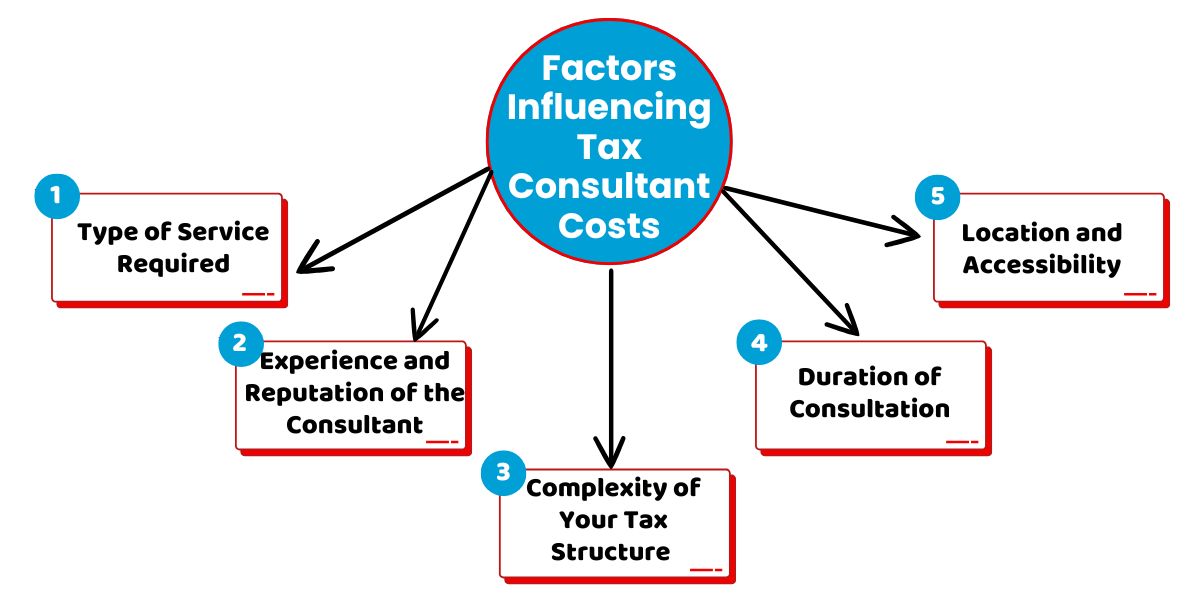

Factors Influencing Tax Consultant Costs in Dubai

Before we get into the numbers, we must know that tax consultation cost is bound to vary by a couple of factors. Such factors may make a difference while you hire professional tax services, so let’s dig a little further into what influences the fee of the tax consultant in Dubai

Type of Service Required

The type of service you need will significantly influence the cost. For instance

VAT Services

Costs from AED 500 to AED 2000. The services include VAT registration, return filing, re-consideration, penalty waiver, voluntary disclosure and de-registration.

Corporate Tax Services

Depending on the needs, these services can cost anywhere from AED 2000 to AED 5000. They include CT registration, return filing, advisory and tax planning for a business to minimize its tax liability which tends to be much costlier.

Experience and Reputation of the Consultant

As in every profession, charges will considerably depend on the experience and the reputation of a tax consultant

- Consultants with extensive experience in fields such as VAT, Corporate Tax, or International Tax can charge between AED 5000 and AED 10,000 per assignment.

- Leading audit firms, such as Premier Auditing & Accounting, will also charge a moderate fee, typically between AED 2500 and AED 7500 considering their reputation and skills.

Complexity of Your Tax Structure

The complexity of your tax structure is another major cost driver

Simple Services

Assisting business with simple tax registration and return filing, for instance, would cost approximately AED 500 to AED 1000.

Complex Services

Involving businesses, foreign tax rules, double taxation, tax treaties or cross-border income. The cost can be from AED 5000 up to AED 10,000, depending on the service requirement.

Duration of Consultation

The time taken for the consultative process is another key factor affecting tax consultant costs

- VAT consultancy can cost anywhere from AED 500 to AED 2000 for a one-time consultation.

- Corporate consultancy that take more than one session could cost between AED 5000 and AED 10,000 or even higher.

Location and Accessibility

The location and accessibility for the consultative process is another key factor affecting tax consultant costs

- Online consultations may start from AED 500.

- Onsite consultations range from AED 1000 to AED 10,000.

Additional Costs to Consider for Tax Consultation

When planning your budget for tax services, you must note that it is not the tax consultation cost only. There are other fees besides consultation fees that you will have to incur while visiting consultants in Dubai

Additional Consultation Hours

The initial consultation might be relatively inexpensive; however, if your tax issues are complex, you may have to spend more time discussing individual matters. Tax consultants usually operate on an hourly basis. It would be great to ask them the hourly rate before they undertake the work.

Service Packages

Some tax consultants offer deals tailored to businesses or individuals. Tax services include registration, filing and annual compliance checks. When choosing a package, ensure you understand the full cost upfront and what’s included.

Follow-up Meetings:

You will also need to pay more for follow-up appointments that might be required for detailed discussions or updates. Ensure you ask about any follow-up fees when you schedule your initial consultation.

Filing Fees or Registration Costs

Registration and filing fees may apply for VAT or Corporate Tax services. Be aware of these costs when planning your overall budget.

Specialized Services

More niche services, such as filing international tax or handling tax disputes, may incur a significantly higher cost; asking the consultant for a detailed estimate on any specialized tax services is highly recommended.

Disbursements

Some consultants charge for administrative work, such as document photocopies, courier services, or government certificates. These are usually passed on to the client and should be discussed upfront.

Is Hiring a Tax Consultant Worth the Cost?

The tax consultant cost in Dubai depends on different factors, such as the nature of the tax services required, how complex the case is, and the consultant’s experience level. With clarity over what you need and how to fulfil, you can find an appropriate tax consultant who might fit for your budget and satisfy the service you need.

In this regard, Premier Auditing and Accounting balances affordability with exceptional ability by offering low-cost tax consulting services in Dubai. Their services include international tax compliance, business tax planning and tax registration and filing. Feel free to reach out to Premier Auditing and Accounting when you need a best tax consultant in Dubai.